Go2Bank has more than ten years of experience in the banking industry. Offered by Green Dot Corporation. The growing suite of products and banking solutions is designed to simplify the economy. This card offers enhanced convenience over more traditional banking institutions. You will get patrons with access to their account 24/7 through AutoPay. This bank makes sure that your money is in safe hands, plus the bank is also facilitating the best of Go2Bank cards to ease your life being an FDIC insured bank. For this you just need to activate it first on the go2bank.com/activate authorized page. Follow the below article to get complete guideline about this card.

Go2Bank Credit card features and benefits:

- With this card you can do on-time payments, late payments, purchases, credit limit changes, and balances owed every month to the three main credit bureaus.

- This credit card is available only to existing GO2bank accountholders with direct deposits totalling at least $100 in the past 30 days.

- You can easily set up ASAP Direct Deposit™ on your GO2bank account, and receive direct deposits totalling at least $100 in the past 30 days.

- You can easily apply for a GO2bank Secured Credit Card within the app.

- You can also make an initial refundable security deposit of at least $100 to set your credit limit.

- This bank also reports your credit standing to the three major credit bureaus every month.

- You do not require credit check or impact to your credit when you apply.

- You have to pay a $0 annual fee.

- You can access a low deposit requirement, fixed APR, and the Visa payment network’s purchasing power.

Go2Bank Credit card apply:

If you want to apply for Go2Bank Credit card then follow these simple steps to apply online.

- First, you have to visit the Go2Bank Secure credit card official website GO2bank.com

- Then you will need to log in with your credentials.

- In case you are eligible to apply then you can find the Apply now button.

- Then you have to tap on the “Apply” button.

- Then you will be redirected to a new website where you have to fill up a form.

- Provide accurate information about your employment and financial status.

- You have to provide details like – Your First Name, Email Address, Create Password, Location, etc.

- Finally, you have to review the fees associated with the credit card of your choice.

- Anyone can submit this application but the decision will depend on the applicant’s financial portfolio.

- You will get your GO2bank Secured Credit Card about 7-10 days after you are approved.

Eligibility for Applying for Go2Bank Credit card:

Applicants need to satisfy the following requirements by the bank to become a successful Go2Bank Credit cardholder.

- Applicants must have a Go2BankCredit card online account.

- You must have a phone number.

- Applicants must be over 18 years of age to use the service.

- You must have good credit (i.e. a score of at least 700) to get the Go2BankCredit Card.

- Only existing GO2bank accountholders with direct deposits totaling at least $100 in the past 30 days can apply for this card.

- You must have proof of your current address.

- You need to have a good record of paying bills on time.

Fees and Charges:

- Annual Percentage Rate (APR) for Purchases: 22.99%

- APR for Cash Advances: 26.99%

- Paying Interest: You will not be charged any interest on purchases if you pay your entire balance by the due date each month or within 25 days.

- Annual Fee: None

- Cash Advance: Either $10 or 5% of the amount of each cash advance

- Foreign Transaction: 3% of each transaction after conversion to U.S. dollars.

- Late Payment: Up to $39

- Over-the-Credit limit: None

- Returned Payment: Up to $20

Necessary things required before activation:

- First you need to have your Go2Bank.com account details.

- You will require an internet connection to complete the process on time.

- You will need a device to execute the activation steps.

Go2Bank Credit card Activation:

- Online method

You will need to have an online account first if you choose to activate your card online. But if you don’t have any online account then first sign up with the details required i.e., bank account details, social security number, and date of birth. Once you get online access, follow these steps to activate your card.

- First, you have to switch on your computer or laptop.

- Then launch your browser.

- Then you will need to type the activation link in the URL –go2bank.com/activate

- You have to click on the “Activate my card now” option if you are a new cardholder.

- Then another page will appear.

- There the system will verify your details to “ensure that you are the only person with access to the account”.

- There you have to provide the last 4 digits of your SSN, your birth details – MM/DD/YYYY and your “Account Number” in the given place.

- Then you have to enter the “Security code” provided on the back of the card, a 3-digit code in case of Master Card or Visa Card. But in case of an AMEX card, the 4 digit will be on the front of your card.

- Then you will need to specify your “Occupation” from the drop-down menu (Engineer/Scientist, Doctor/ Dentist/ Pharmacist, Accountant, Education, Clergy/ Pastor, Cashier/ Clerk/ Server, etc.)

- After that you must clear on whether you are a US citizen.

- For that you have to Click “Yes” or “No” to the question “Are you a United States Citizen?”.

- Then press on the continue button.

- Finally, you have to Follow the onscreen guidelines to complete the card activation process.

Benefits of Online Banking:

You can have some great advantages if you have an online account in a Go2BankCredit card. You must check out these features before creating a Go2BankCredit card online account.

- With online banking you can check balances, transfer money and pay bills.

- You will be able to view and download statements.

- It will be easy to manage Direct Debits and standing orders.

- You can view your debit card PIN.

- You can easily report a lost or stolen card.

How to get online access to your credit card account:

- First, you need to visit the official page go2bank.com/activate

- Then you have to create Victoria’s Secret card account.

- You have to provide your Credit card account number Zip-code or postal code, Identification Type (Social Security Number or SSN), Last four (4) digits of SSN in the given place.

- Finally, you have to tap on the option that says “Find My Account”.

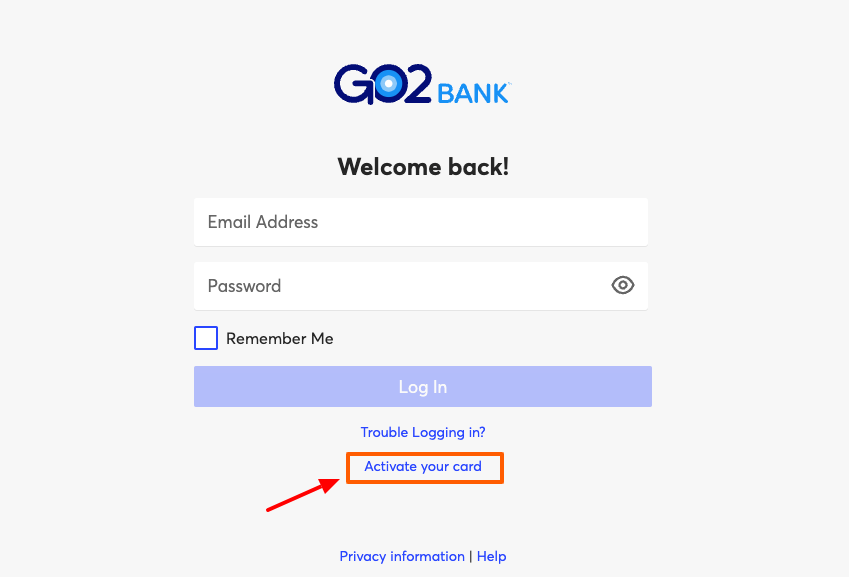

Go2Bank Credit card Login:

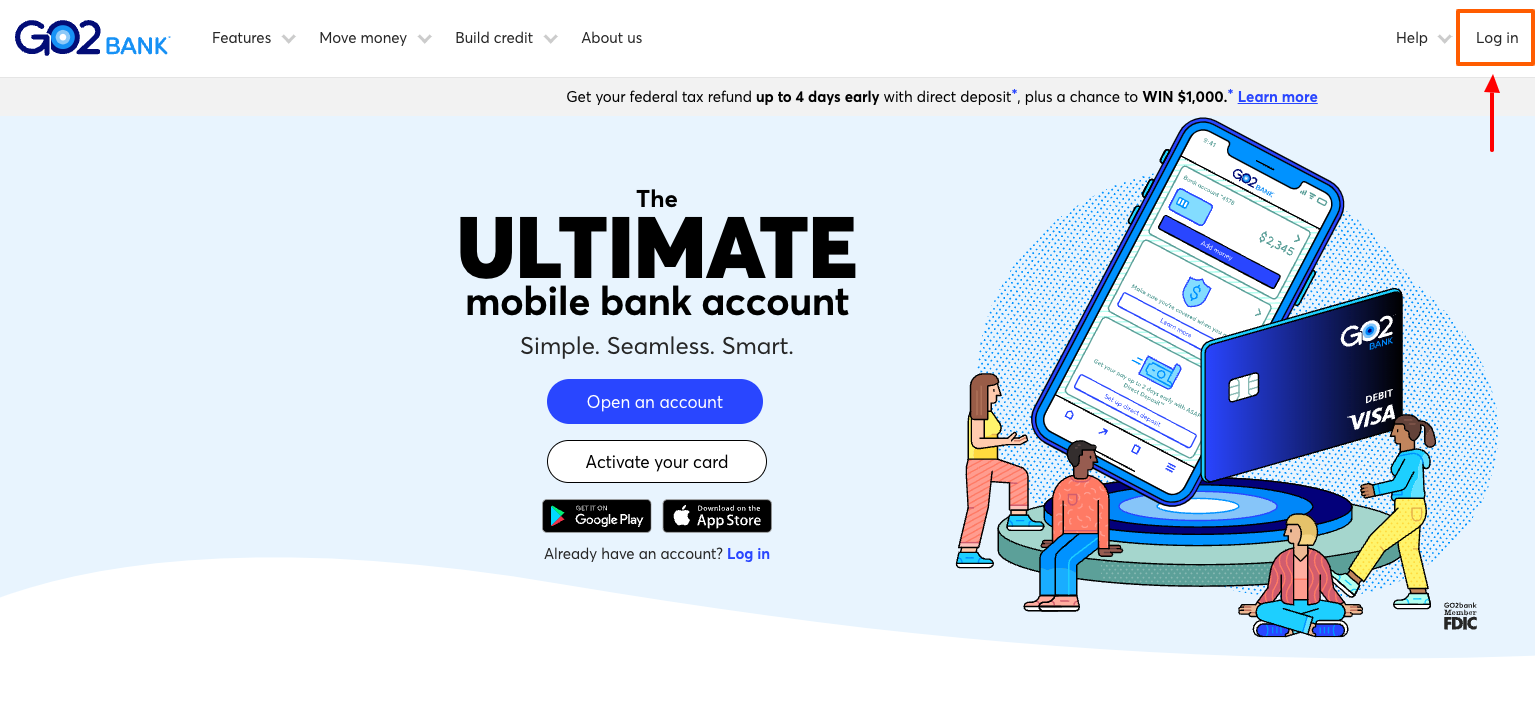

- First, you have to Launch your web browser (Chrome or Safari) on the laptop or computer.

- Then you will need to navigate to www.go2bank.com

- There you have to find the option that says “Login”.

- Provide your last name, and either your Online Banking membership number, your card number, or your sort code and account number to the mandatory fields given.

- Click on the ‘Next step’ option.

- Then press the ‘Log in with passcode’ option there.

- You have to be sure that the ‘Login details’ option is selected.

- There you have to provide your passcode and the requested characters of your memorable word.

- Then tap on the ‘Continue’ when you’re ready.

- For an extra security check, you may be asked for your card details.

- You have to type the one-time security code on your computer once you get it.

- Finally, tap on ‘Log in to Online Banking’ to continue.

Go2Bank Credit card password recovery:

If you’ve forgotten any of your login details then don’t need to worry about it. You need to follow these simple steps for resetting your user’s name or password.

- First you have to visit the Go2Bank credit card go2bank.com/activate page.

- You have to choose the option – “Trouble Logging in”.

- You have to find the “Forgot Username or Password?” link.

- You have to tap on it after finding the link.

- A new page will appear.

- Verify your account in that page.

- You have to provide the last 4 digits of your SSN, DOB in the DD/ MM/ YYY format, and Account Number there in the given place.

- Finally, you have to tap on the “Continue” button.

- You can retrieve your username or password easily.

Go2Bank Credit card bill payment:

You can use the Go2Bank credit card official website for making a Go2Bank credit card payment online. You can also pay by phone, through the online website, by mail or at a branch. There you can also review your statements and account balance, can set up payment notifications and manage your card. There you can also choose how much to pay, when to pay it, and where the payment is coming from.

- Online bill payment:

You’ll first need to set up online access and then log in through the site or app and set up a payment account like your savings or checking account.

- First you have to Log in to your Go2Bank Credit card account online.

- You will need to register for online account access first. For this you have to choose “Register” and provide your credit card number, ZIP code and the last four digits of your Social Security number.

- After that, you have to log in to your account using the username and password you selected.

- There you will have to choose “Payments” from the main navigation menu.

- There you have to select “Make a Payment.” Option.

- Then you will need to link an eligible checking or savings account from which to make payments.

- You have to choose the “Add a bank account” option there and provide your account details.

- Then select a payment amount from the available options there and pay the minimum amount due, the full statement balance, the current statement balance, or enter another amount of your choosing.

- You have to select a payment date, or simply select “pay now” to send your payment on the earliest date available.

- Then choose a payment account from your available bank accounts.

- After that tap on “Review and Verify” to confirm the details of your payment.

- Finally tap on the “Pay now” to make your payment.

- You can set a payment date, amount, and payment account to be used for each automatic payment through selecting a Repeat payment option.

- If make your payment online before 6 p.m. on the due date, you won’t be charged a late fee.

Payment through mail:

If you want to use a check or money order but not cash, you can mail your payment in to Go2Bank credit card. You have to Put your card number on the memo or note field of your money order or check so the company applies it to the right account. You have to be sure to send it early enough that it will arrive by the due date. Mail it to

GO2bank P.O. Box 5100, Pasadena, CA 91117.

Getting Started with your Go2Bank Credit card:

For starting the use of your Go2Bank Credit card, you have to follow certain steps which are mentioned below. Check out these steps before activating your card.

- First you need to set up direct deposit on your GO2bank account.

- You will receive direct deposits totalling at least $100 in the past 30 days.

- Now you can easily apply for a GO2bank Secured Visa Credit Card within the app or online.

- Then you have to activate your Go2Bank Credit card.

- Then visit www.go2bank.com/help/getting_started to set up online access.

- You have to transfer at least $100 from your GO2bank account to make your security deposit and set your credit limit.

- You have to update any bill payment services for paying your credit card bill with your new account information.

- You have to set up automatic bill payments for your account. Update online merchant accounts for storing your credit card information for expedited checkouts as well as any digital wallets.

- You have to manage your account online, set up repeat payments, enroll in paperless statements for viewing your cards feature and benefits.

Lock your Go2Bank Credit card:

You can instantly lock and unlock your Go2Bank Credit card if lost or misplaced to prevent it from being used for purchases from its mobile app. You will also be able to set transaction limits and even block certain purchases for yourself or authorized users with its Control your card feature. Go2Bank credit card will send you notifications through which you can monitor spending and catch fraudulent purchases as soon as they happen. You just have to follow these few simple steps.

- Open your Go2Bank credit card official website.

- Log in with your credentials.

- You have to select the card you want to freeze.

- Then visit the Menu section.

- Then tap on the “Manage Card” option.

- After that press the “Lock or Unlock this card” option there.

- You have to change the settings so that your card is in the locked position.

- This will stop new purchases with the card, including cash advances.

- But this will allow merchant-indicated recurring bill payments, returns, credits, dispute adjustments, payments, account fees, interest, and rewards redemptions.

- You have to navigate back to the Secure Hold page and unlock your card to use your card again.

Customer Support:

For general concerns, there is customer support which will help you 24 hours a day, 7 days a week.

You can contact the Customer Service phone number on the back of your credit card.

First you need to visit www.go2bank.com/help/contact-us

You can chat with them 5 am-9 pm PST, 7 days a week.

You just need to click on the Chat icon located on the bottom right of your screen to chat.

You can also contact Customer Support at (855) 459-1334

5 am-9 pm PST, 7 days a week.

You can mail them at GO2bank P.O. Box 5100, Pasadena, CA 91117

Reference:

www.go2bank.com/help/contact-us