Aviator Red World Elite Mastercard is a fantastic card for airline enthusiasts or anyone who travels frequently. If you love to travel a lot with American Airlines then you will truly appreciate the advantages of the Aviator Master Card offered by Barclays. But first, you need to activate your Aviator Master card via the official portal – aviatormastercard.com/activate

Here in this article, you will get complete information about how to activate your Aviator Master card.

Aviator Master card features and benefits:

- On all purchases with American Airlines, you will earn 2x miles.

- You will get an unlimited 1.5 mile per $1 on all other purchases.

- You don’t need to pay any foreign transaction fees.

- You will get the benefits of chip technology.

- You will not responsible for unauthorized charges you report to them with the 0% fraud liability protection.

- You will get a sign-up bonus of 50,000 miles when you spend $3,000 in the first 3 months.

- After spending $40,000 on purchases during the first year of card membership with 15,000 elite qualifying miles (EQM) you’ll have more opportunities to fly in your elite status.

- You can enjoy a generous welcome bonus of 25,000 bonus miles after making $1,000 in purchases within the first three months of Card Membership.

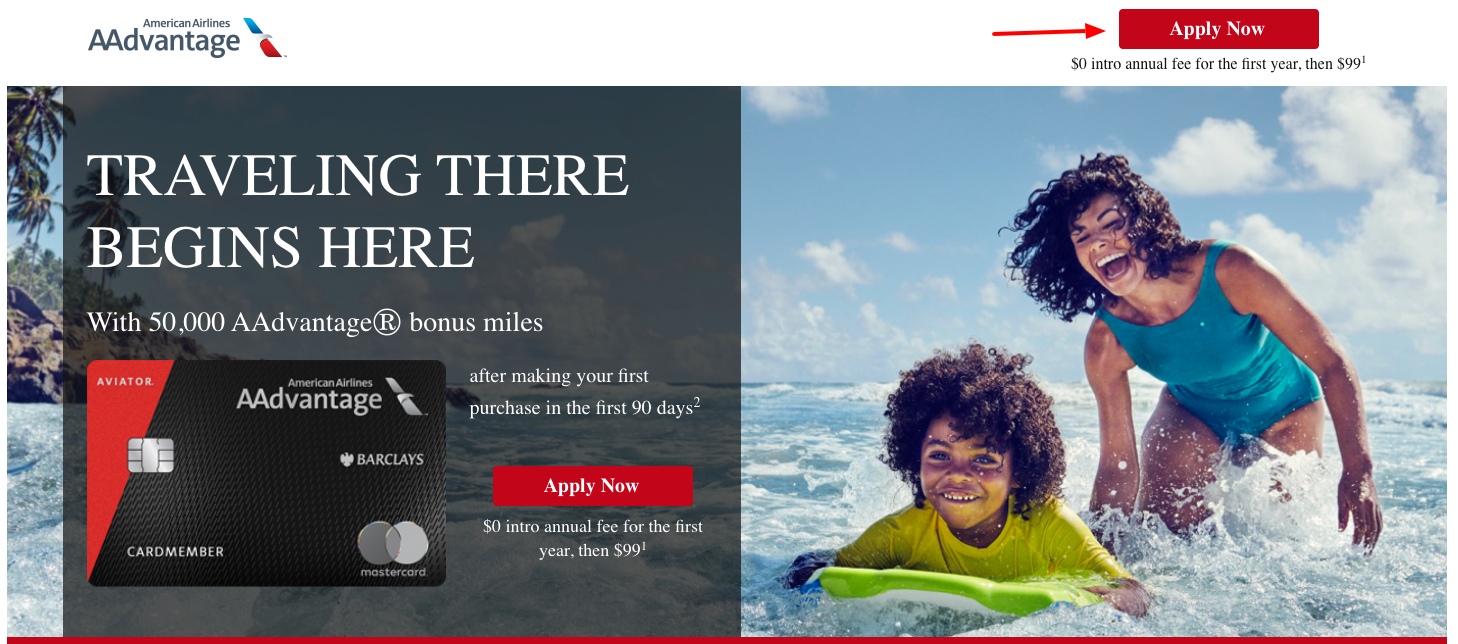

Aviator Master card Apply:

If you want to apply for Aviator Master Card then follow these simple steps to apply online.

- First you have to visit the Aviator official website applyaviator.com

- There you have to choose your card.

- Then click on Apply now button.

- Then you will be redirected to a new website where you have to fill up a form.

- Provide accurate information about your employment and financial status.

- Finally, you have to review the fees associated with the credit card of your choice.

- Anyone can submit this application but the decision will depend on the applicant’s financial portfolio.

Eligibility for Applying for Aviator Master card:

Applicants need to satisfy the following requirements by the bank to become a successful Aviator master cardholder.

- Applicants must have an Aviator’s online account.

- You must have a phone number.

- Applicants must be over 18 years of age to use the Aviator app.

- You must have good credit (i.e. a score of at least 700 or higher) to get the Aviator Credit Card.

- You must not be bankrupt or had an Individual Voluntary Arrangement or Debt Relief Order in the last six years.

- You must not have any outstanding County Court Judgement (CCJ’s) in the last six years.

- You must have proof of your current address.

- You need to have a good record of paying bills on time.

Fees and Charges:

- Purchase APR (Variable APR): 15.9% – 24.9%

- Balance Transfer APR (Variable APR): 15.9% – 24.9%

- Credit Score Range: 650 – 850

- Annual Fee: $95

- Signup bonus: After spending $1,000 you will get a signup bonus of 60000 points that can be redeemed for travel, gifts, or other perks.

- Competitive APRs: You will get a variable purchase APR that ranges from 15.9% up to 24.9% using this Barclay’s AAdvantage Aviator Mastercard.

- 3% Balance transfer fee: You will be charged a fee of 3% on balance transfers using this Barclay’s AAdvantage Aviator Mastercard. For example, a balance of $1,000 could cost $30 in transfer fees. The minimum fee is $5.

- No foreign transaction fee: You don’t need to pay a fee when you make a purchase that passes through a foreign bank or is in a currency other than the U.S. dollar (USD). This makes it a great credit card to carry when traveling abroad.

- Multiple business credit card benefits: You can get generous credit card perks, such as rental insurance, emergency support, extended warranty protection on purchases, travel assistance, and fraud protection.

- Fair or better credit required: If your credit score is above 650 then you will have good approval odds

Pros of Aviator Master card:

- They will offer potentially lower than average purchase APRs.

- Enjoy multiple business credit card perks.

- You will get an auto rental collision damage waiver.

- You can access an extended warranty on purchases.

- Get travel assistance insurance

- Don’t need to pay any foreign transaction fee.

- As a cardholder, you can earn rewards on purchases everywhere Barclay’s AAdvantage Aviator Mastercard is accepted.

- Barclay’s AAdvantage Aviator Mastercard reports to multiple credit bureaus.

Cons of Aviator Master card:

- You will be charged an annual fee of $95

- You have to pay a 3% balance transfer fee.

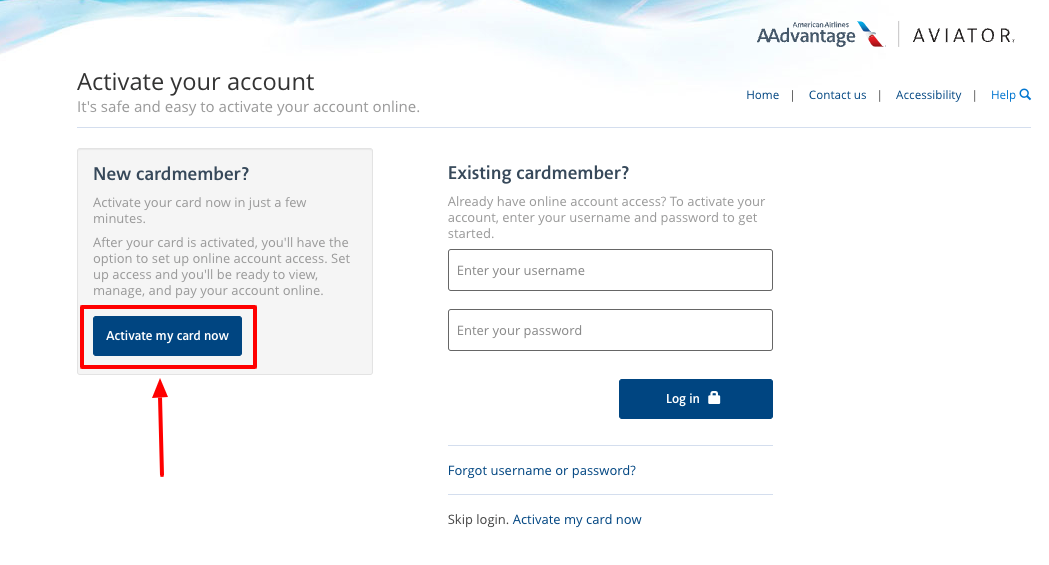

Aviator Master Card Activation:

- Online method

You will need to have an online account first if you choose to activate your card online. But if you don’t have any online account then first sign up with the details required i.e., bank account details, social security number, and date of birth. Once you get online access, follow these steps to activate your card.

- First, you have to switch on your computer or laptop.

- Then launch your browser.

- Then you will need to type the activation link in the URL – aviatormastercard.com/activate

- You have to click on the “Activate my card now” option if you are a new cardholder.

- Then another page will appear.

- There the system will verify your details to “ensure that you are the only person with access to the account”.

- There you have to provide the last 4 digits of your SSN, your birth details – MM/DD/YYYY and your “Account Number” in the given place.

- Then you have to enter the “Security code” provided on the back of the card, a 3-digit code in case of Master Card or Visa Card. But in the case of an AMEX card, the 4-digit will be on the front of your card.

- Then you will need to specify your “Occupation” from the drop-down menu (Engineer/Scientist, Doctor/ Dentist/ Pharmacist, Accountant, Education, Clergy/ Pastor, Cashier/ Clerk/ Server, etc.)

- After that you must clear on whether you are a US citizen.

- For that you have to Click “Yes” or “No” to the question “Are you a United States Citizen?”.

- Then press on the continue button.

- Finally, you have to Follow the onscreen guidelines to complete the card activation process.

Through phone call:

If you don’t have any Wi-Fi and still want to activate your card then you can follow these steps to activate your card.

- First you have to switch on your Phone.

- Then call at 1-877-408-8866.

- You have to Follow the instructions to easily activate your Aviator master card.

- You can easily get the number from the “Contact Us” page if you have knowledge of internet.

- For that you just need to Visit the homepage of Aviator Master card and select “Contact Us” option available there.

- Now you can enjoy all the maximum perks and benefits associated with the card.

Through Aviator mobile app:

You have to check these steps to activate the card using your Aviator Card.

- First you have to install the Aviator app on your smartphone.

- You have to log in.

- Then press the option “Aviator Master card”.

- Your card has been activated.

- Now you can manage your account as well.

Aviator Master card Login:

- First, you have to Launch your web browser (Chrome or Safari) on the laptop or computer.

- Then you will need to navigate to www.aviatormastercard.com/servicing/home

- Then the welcome page will appear.

- There you will need to provide your login details like user name and password.

- Then you have to click on the continue button.

- Finally, you are logged in to your Aviator Master Card account.

Aviator Master card password recovery:

If you’ve forgotten any of your login details then don’t need to worry about it. You need to follow these simple steps for resetting your user’s name or password.

- First you have to visit the Aviator MasterCard activation page.

- Then scroll down to the screen and you have to find for the “Forgot Username or Password?” link.

- You have to tap on it after finding the link.

- A new page will appear.

- Verify your account in that page.

- You have to provide the last 4 digits of SSN, Date of Birth, and Account Number there in the given place.

- Finally, you have to tap on the “Continue” button.

- You can retrieve your username or password easily.

Aviator master card bill payment:

You can use the Aviator online website or mobile app for making an Aviator Master card payment online. You can also pay by phone, through the mobile app, by mail or at a branch. There you can also review your statements and account balance, can set up payment notifications and manage your card. There you can also choose how much to pay, when to pay it, and where the payment is coming from.

- Online bill payment:

You’ll first need to set up online access and then log in through the site or app and set up a payment account like your savings or checking account.

- First you have to Log in to your Aviator Master card account online.

- You can also launch the Aviator App on your mobile device.

- There you will have to choose “Payments” from the main navigation menu.

- There you have to select “Make a Payment.” Option.

- Then you will need to link an eligible checking or savings account from which to make payments.

- You have to choose “Add a bank account” option there and provide your account details.

- Then select a payment amount from the available options there and pay the minimum amount due, the full statement balance, the current statement balance, or enter another amount of your choosing.

- You have to select a payment date, or simply select “pay now” to send your payment on the earliest date available.

- Then choose a payment account from your available bank accounts.

- After that tap on “Review and Verify” to confirm the details of your payment.

- Finally tap on the “Pay now” to make your payment.

- You can set a payment date, amount, and payment account to be used for each automatic payment through selecting a Repeat payment option.

Payment through mail:

If you want to use a check or money order but not cash, you can mail your payment in to Aviator’s. You have to Put your card number on the memo or note field of your money order or check so the company applies it to the right account. You have to be sure to send it early enough that it will arrive by the due date. Mail it to

Remitco

Card Services

Lock Box 60517

2525 Corporate Place, Suite 250

Monterey Park, CA 91754.

- Call In payment:

You can make an Aviator Master card payment by phone using a checking or savings account which requires calling to reach the cardholders’ services.

The system will prompt you to give the last four digits of the card you need to pay during call and will ask for the last four numbers of your Social Security number to check that you’re the right cardmember. Then you have to confirm the information, you’ll access a voice automated system that will tell you information about your accounts such as your payment due date and minimum payment.

Then tell the automated system you want to make a payment and follow the prompts to give a payment amount and date and provide the information for the account you want to use to make a payment. At the end of the call, you will get a payment confirmation number.

Getting Started with your Aviator Master Card:

For starting the use of your Aviator master card, you have to follow certain steps which are mentioned below. Check out these steps before activating your card.

- First you have to Login to your AAdvantage® Aviator® Mastercard® account.

- Then you have to tap on “Manage Flight Cents™” option available there.

- Then you will need to set your threshold for the maximum amount you’d like to round up each statement period.

- You can do all your purchases including gas, groceries and dining using your AAdvantage® Aviator® Mastercard®.

- Up to your threshold amount for every 2 cents you round up you will get 1 AAdvantage® mile.

Check Aviator Master card status online:

You can check the status of your online application by following these steps.

- You have to visit the official portal – www.aviatormastercard.com/servicing/home

- Then you have to tap on the option Check the status of your application now.

- Finally, you have to complete the online formalities.

- Now you can view your tickets.

Lock your Aviator Master card:

You can instantly lock and unlock your Aviator Master card if lost or misplaced to prevent it from being used for purchases from its mobile app. You will also be able to set transaction limits and even block certain purchases for yourself or authorized users with its Control your card feature. Aviator app will send you notifications through which you can monitor spending and catch fraudulent purchases as soon as they happen. You just have to follow these few simple steps.

- Open your Aviator mobile app first.

- Log in with your credentials.

- You have to select the card you want to freeze.

- Then tap on the “Control Your Card” option.

- After that press the “Lock or Unlock this card” option there.

- You have to change the settings so that your card is in a locked position.

- This will stop new purchases with the card, including cash advances.

- But this will allow merchant-indicated recurring bill payments, returns, credits, dispute adjustments, payments, account fees, interest, and rewards redemptions.

- You have to navigate back to the Secure Hold page and unlock your card to use your card again.

Customer Support:

For general concerns, there is the customer support which will help you 24 hours a day, 7 days a week.

You can contact the Customer Service phone number on the back of your credit card.

Phone:

You can contact your dedicated Customer Service Team at:

1-866-928-3075

Credit card activation

1-877-408-8866

Fax number

1-866-823-8178

International (Call us collect)

1-302-255-8888

For Hearing or Speech Impaired

711

TTY/TDD: 1-866-483-3705

Mail address:

General Correspondence

Card Services

P.O. Box 8801

Wilmington, DE 19899-8801

Credit Card Billing Disputes

Card Services

P.O. Box 8802

Wilmington, DE 19899-8802

You can send a written dispute to the following address.

Card Services

P.O. Box 8803

Wilmington, DE 19899-8803

Credit Balance Refunds

Card Services

P.O. Box 8746

Wilmington, DE 19899-8746customerweb.contactUsMailText5.headline=Credit Card Payments

Card Services

P.O. Box 60517

City of Industry, CA 91716-0517

Overnight Credit Card Payments

(Using specific labels and envelopes through UPS, Mail Boxes Etc., FedEx, U.S. Mail)

Remco

Card Services

Lock Box 60517

2525 Corporate Place, Suite 250

Monterey Park, CA 91754

Card Services

P.O. Box 13337

Philadelphia, PA 19101-3337

Overnight Credit Card Payments

(Using specific labels and envelopes through UPS, Mail Boxes Etc., FedEx, U.S. Mail)

Card Services

400 White Clay Center Drive

Newark, DE 19711

Physical Address

Barclays Bank Delaware

125 South West Street

Wilmington, DE 19801

Collections/Account Verification

(For Account Verification, Debt Validation, Cease & Desist, Legal Representation, or any other collections related inquiry please send your request to the below address)

Card Services

P.O. Box 8833

Wilmington, DE 19899-8833

Reference: