Capital One Credit Card Login – www.creditonebank.com

Credit One Bank is a technology and data-driven financial services company based in Las Vegas, Nevada. This company offer a full range of consumer credit card products. Being one of the largest credit card banks in the United States, Credit One Bank issues Visa®, Mastercard® and American Express® cards to millions of card members nationwide. They provide an excellent customer service and an array of credit card products loaded with innovative features. They offer a full spectrum of credit card products that are perfect for everyday purchases and provide meaningful benefits, helpful features, and state-of-the-art security.

You just need to follow this article mentioned below to get a complete guide to Go credit one card.

Benefits and Rewards of Go Credit One credit cards:

There are 14 cards available to choose details of which are given below.

Platinum reward visa:

- You can earn 5% cash back rewards on the first $5,000 of eligible purchases on gas, grocery, and internet, cable, satellite TV and mobile phone services each year, then 1% thereafter.

- You can get Unlimited 1% cash back rewards on all other purchases

- You will get up to 10% More Cash Back Rewards from participating merchants automatically.

Credit One Bank American Express Card:

- You can get unlimited 1% cash back rewards on all purchases

- Get retail Protection

- Earn special benefits and Amex Offers

Platinum Visa For Rebuilding Credit:

- You can access 1% cash back rewards on eligible purchases of gas, grocery, and internet, cable, satellite TV and mobile phone services.

- Get Regular reviews for credit line increases.

- You will get ability to choose your payment due date.

Platinum Rewards Visa with No Annual Fee:

- You can get 2% cash back rewards on eligible purchases of gas, grocery, and internet, cable, satellite TV and mobile phone services.

- Enjoy Free online access to your Experian credit score.

- You can Automatically get up to 10% More Cash Back Rewards from participating merchants.

Credit One Bank Wander Card:

- You can buy an $80 National Park Pass with your Wander card on site at a National Park.

- You can also earn 5X points on eligible recreational & amusement park purchases, 3X points on eligible restaurant & lodging purchases, and 1X points on all other purchases.

- You can easily redeem your Wander Card reward points for statement credits, gift cards, merchandise, and more.

Credit one bank wander card with no annual fee:

- You can get 3X points on eligible recreational & amusement park purchases, 2X points on eligible restaurant & lodging purchases, and 1X points on all other purchases.

- Get access to redeem your Wander card rewards points for statement credits, gift cards, merchandise, and more.

Platinum visa:

- You can get 1% cash back rewards on eligible purchases of gas, grocery, and internet, cable, satellite TV and mobile phone services.

- Enjoy online access to your Experian credit score.

- You can get up to 10% More Cash Back Rewards from participating merchants automatically.

Secure card:

- This is the best card for building or rebuilding credit

- You can earn 1% cash back rewards on eligible purchases of gas, grocery, and internet, cable, satellite TV and mobile phone services.

- You can get interest on your security deposit account.

Best friends credit card:

- Best Friends will receive a donation in an amount equal to 1% of eligible purchases made with this card.

- You can earn 5% cash back rewards on eligible pet shops, pet foods, and supplies stores purchases for the first $5,000 per calendar year, and then 1% thereafter.

- You can automatically get up to 10% More Cash Back Rewards from participating merchants.

NASCAR American Express card:

- You can get 1% cash back rewards on all purchases.

- Get free Scanner access on Desktop or within the NASCAR® mobile app for the 2022 race season.

- You will get discounts on select NASCAR® race tickets, parking, merchants, and other race experiences.

WWE champion credit card:

- You can earn 3% cash back rewards on eligible internet, cable and satellite TV, and mobile phone service purchases.

- You can earn 2% cash back rewards on eligible dining purchases.

- You can earn 1% cash back rewards on all other eligible purchases.

WWE superstar credit card:

- You can earn 1% cash back rewards on eligible internet, cable and satellite TV, and mobile phone service purchases, as well as eligible dining purchases

- Get opportunities to Meet and Greet with WWE® Superstars.

- Get unique WWE® Shop discount offers at the online merchandise store.

Vegas Golden knights credit card:

- You can enjoy 1% cash back rewards on eligible purchases of gas, grocery, and internet, cable, satellite TV and mobile phone services.

- Enjoy stunning Vegas Born designs for showing off your team pride.

Six flags rewards visa:

- Get 1% cash back rewards on eligible purchases of gas, grocery, and internet, cable, satellite TV and mobile phone services.

- Enjoy online access to your Experian credit score.

- You can get up to 10% More Cash Back Rewards from participating merchants.

Go Credit One Card apply:

You can easily apply for the Go Credit One card either online or in-person at its store. If you want to apply for Go Credit One Card then follow these simple steps to apply online.

- First you have to visit the Go Credit One card official website.

- Then type your last name and personal id code in the given space.

- Then click on Apply now button.

- Then you will be redirected to a new website where you have to fill up a form.

- Provide accurate informations about your employment and financial status.

- Finally, you have to review the fees associated with the credit card of your choice.

- Anyone can submit this application but the decision will depend on the applicant’s financial portfolio.

Eligibility for Applying Go Credit One Card:

Applicants need to satisfy the following requirements by the bank to become a successful Go Credit One Card holder.

- Applicants must have a Go Credit One card’s online account.

- You must have a phone number.

- Applicants must be over 18 years of age to use the Go Credit One card app.

- You must have a good credit score to get this credit Card.

- You must not been bankrupt or had an Individual Voluntary Arrangement or Debt Relief Order in the last six years.

- You must not have any outstanding County Court Judgement (CCJ’s) in the last six years.

- You must have proof of your current address.

- You must be a legal resident of the United States.

- You need to have a good record of paying bills on time.

Also Read:

Manage your Amex Business Gold Card at amex.us/getbusinessgold

Access Chase Credit Card Offer Account

Steps to Register your TJX Rewards Credit Card Account

Fees and Charges:

- Annual Percentage Rate (APR) for Purchases: 23.99%

- Annual Percentage Rate (APR) for Cash Advances: 23.99%

- How to Avoid Paying Interest on Purchases: Your grace period is at least 24 days after the close of each billing cycle. You will not be charged any interest on Purchases if you pay your entire balance by the due date each month.

- Minimum Interest Charge: in case interest will be charged then charge will be no less than $1.00.

- Annual fee: $95.

- Cash advance: Either $10 or 5% of the amount of each Cash Advance, whichever is greater.

- Foreign transaction: Either $1 or 3% of each purchase in U.S. dollars, whichever is greater.

- Late fee: Up to $39

- Return payment: Up to $39

Go Credit One Card Activation:

- Through phone call:

If you don’t have any Wi-Fi and still want to activate your card then you can follow these steps to activate your card.

- First you have to switch on your Phone.

- Then dial (877) 825-3242.

- Your card activation phone number will also be printed on the decal affixed to the front of the new card.

- It is recommended to call from the telephone number that you listed on your application.

- In case you call from a different phone then you have to provide that phone number to the customer service.

- On call you will need to provide your 16-digit credit card number.

- Then the call will automatically route to the Credit One card activation menu.

- After that you have to provide your birth date, your Social Security number (SSN) and the card’s 3-digit security code.

- You have to Follow the instructions to easily activate your credit one card.

- You can easily get the number from the “Contact Us” page if you have knowledge of internet.

- For that you just need to Visit the homepage of Go Credit One card and select “Contact Us” option available there.

Benefits of Online Banking:

You can have some great advantages if you have an online account in Go Credit One Card. You must check out these features before creating a Go Credit One card online account.

- With online banking you can check balances, transfer money and pay bills.

- You will be able to view and download statements.

- It will be easy to manage Direct Debits and standing orders.

- You can view your debit card PIN.

- You can easily report a lost or stolen card.

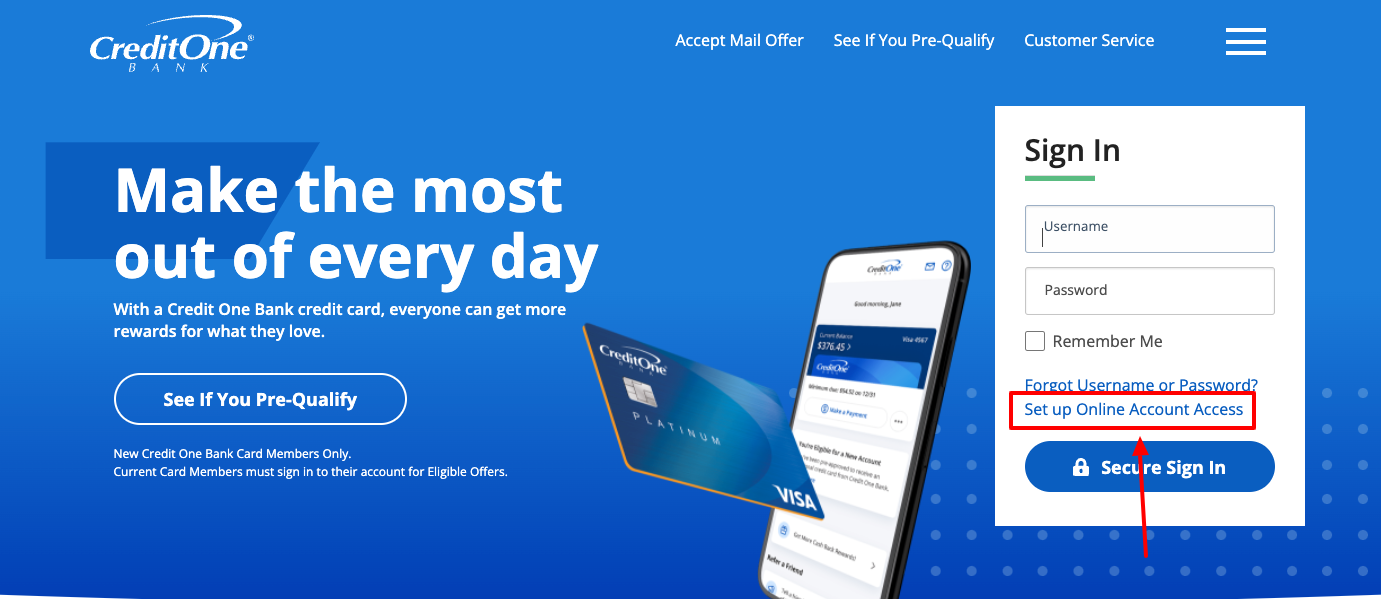

Capital One Credit Card Set up:

- First you have to Launch your web browser (Chrome or Safari) on the laptop or computer.

- Then you will need to navigate to www.creditonebank.com

- There in case you are a new customer then, you have to find for the option that says “set up online account access”.

- Provide your credit card number, card security code, good through date, Social security number to the mandatory fields given.

- Click on ‘Next step’ option.

- Then create your user-name and password there.

- Then tap on the ‘Continue’ when you’re ready.

- For login again visit the login page.

- There you will be asked for your login details.

- You have to type the user-name and password in the given place.

- Finally, tap on ‘Log in’ to continue.

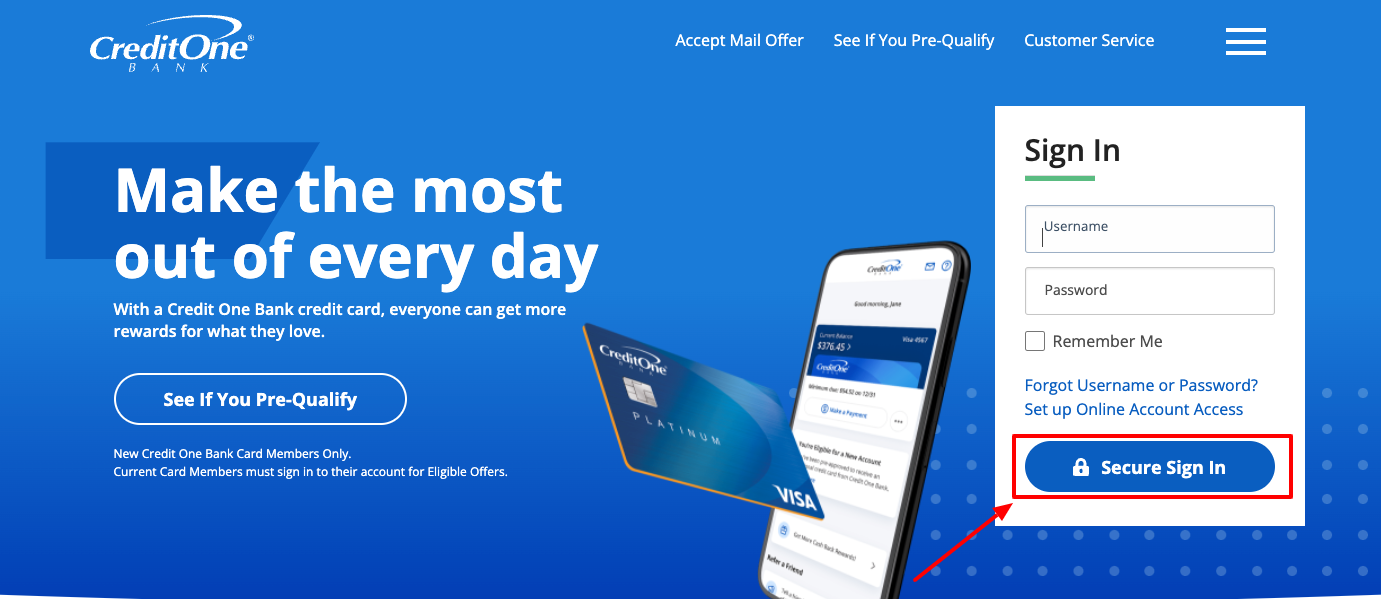

Capital One Credit Card Login Guide Online:

- First you have to visit the login page at www.creditonebank.com

- Then there you have to find the option Sign In part.

- There you have to enter your Username and password.

- Then check on the Remember me check box if you want to save your login credentials.

- After that click on the Secure Login button.

Capital One Credit Card Password Recovery:

If you’ve forgotten any of your login details then don’t need to worry about. You need to follow these simple steps for resetting your user’s name or password.

- First you have to visit the Go Credit One card login page www.creditonebank.com

- You have to find for the “Forgot Username or Password?” link.

- You have to tap on it after finding the link.

- A new page will appear.

- Verify your account in that page.

- You have to provide the last 4 digits of your SSN, DOB in the DD/ MM/ YYY format, and Account Number there in the given place.

- Finally, you have to tap on the “Continue” button.

- You can retrieve your username or password easily.

Credit One Credit Card Bill Payment:

You can use the Go Credit One website or mobile app for making a Go Credit One credit card payment online. You can also pay by phone, through the Go Credit One mobile app, by mail or at a branch. There you can also review your statements and account balance, can set up payment notifications and manage your card. There you can also choose how much to pay, when to pay it, and where the payment is coming from.

- Online bill payment:

You’ll first need to set up online access and then log in through the site or app and set up a payment account like your savings or checking account.

- First you have to Log in to your Go Credit One Card account online.

- You can also launch the Go Credit One App on your mobile device.

- There you will have to choose “Payments” from the main navigation menu.

- There you have to select “Make a Payment.” Option.

- Then you will need to link an eligible checking or savings account from which to make payments.

- You have to choose “Add a bank account” option there and provide your account details.

- Then select a payment amount from the available options there and pay the minimum amount due, the full statement balance, the current statement balance, or enter another amount of your choosing.

- You have to select a payment date, or simply select “pay now” to send your payment on the earliest date available.

- Then choose a payment account from your available bank accounts.

- After that tap on “Review and Verify” to confirm the details of your payment.

- Finally tap on the “Pay now” to make your payment.

- You can set a payment date, amount, and payment account to be used for each automatic payment through selecting a Repeat payment option.

Set Autopay:

- First you will need to sign in to your account online.

- Then you have to click on ‘Pay Bill’ in the top menu bar.

- After that tap on the ‘AutoPay’ option and then click on ‘Set Up’.

- You have to choose an account from the ‘Pay To’ selector if you have more than one account.

- Then choose your payment account from the ‘Pay From’ selector.

- After that you need to select whether you would like to pay your Minimum Payment or Last Statement Balance.

- Then click on the continue button.

- Finally, you need to verify the details you selected are correct and click ‘Confirm’ to finish setting up AutoPay.

- You will get a confirmation notice with the start date of your first automatic payment.

- You have to pay at least your Minimum Payment for that month using a one-time payment to avoid a late fee if you set up AutoPay within 4 days of your Payment Due Date.

- Payment through mail:

If you want to use a check or money order but not cash, you can mail your payment in to Go Credit One card’s. You have to Put your card number on the memo or note field of your money order or check so the company applies it to the right account. You have to be sure to send it early enough that it will arrive by the due date. Mail it to

Credit One Bank, Payment Services, P.O. Box 60500, City of Industry, CA 91716-0500.

- Call In payment:

You can make a Go Credit One Card payment by phone using a checking or savings account which requires calling 877-825-3242 to reach the cardholders’ services.

The system will prompt you to give the last four digits of the card you need to pay during call and will ask for the last four numbers of your Social Security number to check that you’re the right card member. Then you have to confirm the information, you’ll access a voice automated system that will tell you information about your account such as your payment due date and minimum payment.

Then tell the automated system you want to make a payment and follow the prompts to give a payment amount and date and provide the information for the account you want to use to make a payment. At the end of the call, you will get a payment confirmation number.

Getting Started with your Go Credit One Card:

For starting the use of your Go Credit One Card, you have to follow certain steps which are mentioned below. Check out these steps before activating your card.

- First you have to activate your Go Credit One Card.

- For this you have to call customer service at (877) 825-3242.

- You have to update any bill payment services for paying your credit card bill with your new account information.

- You have to set up automatic bill payments for your account. Update online merchant accounts for storing your credit Card informations for expedited check outs as well as any digital wallets.

- You have to manage your account online, set up repeat payments, enroll in paperless statements for viewing your cards feature and benefits.

Lock your Go Credit One Card:

You can-not freeze your Go Credit One Card if lost or misplaced you have to to call Credit One credit card customer service at 1 (877) 825-3242 as soon as possible so they can cancel the card and send you a new one. You have to keep in mind that you won’t be held responsible for unauthorized purchases. They provide you a $0 fraud liability guarantee.

Customer Support:

For general concerns, there is a customer support which will help you 24 hours a day, 7 days a week.

You can contact their customer service executives through these following details.

Automated Account Information:

1-877-825-3242 (toll-free, TDD/TTY)

1-702-405-2042 (outside the U.S.)

(24 hours a day / 7 days a week)

Application Information:

1-800-752-5493

(5 a.m. – 9 p.m. Mon – Fri, 6:30 a.m. – 5 p.m. Sat & Sun / All Times Pacific)

Lost or Stolen Cards:

1-877-825-3242

(24 hours a day / 7 days a week)

Credit Protection:

1-877-825-3242

(5 a.m. – 9 p.m. Mon – Fri, 6:30 a.m. – 5 p.m. Sat & Sun / All Times Pacific)

Collections:

1-888-729-6274

(5 a.m. – 7 p.m. Mon – Thu, 5 a.m. – 3 p.m. Fri & Sat, 7 a.m. – 3 p.m. Sun / All Times Pacific)

Website Related Inquiries:

1-800-797-4299

(5 a.m. – 9 p.m. Mon – Fri, 6:30 a.m. – 5 p.m. Sat & Sun / All Times Pacific)

Mailing address:

You can also mail them through this following given address,

Payments:

Credit One Bank

Payment Services

P.O. Box 60500

City of Industry, CA 91716-0500

General Correspondence:

Credit One Bank

P.O. Box 98873

Las Vegas, NV 89193-8873

Errors or Questions About Your Bill:

Credit One Bank

P.O. Box 98873

Las Vegas, NV 89193-8873

Credit Protection Written Correspondence:

Credit One Bank

P.O. Box 98873

Las Vegas, NV 89193-8873

Reference: