Comparison between Capital One Savor and Uber Visa Credit Card Online

Capital One Savor vs Uber Visa Credit Card Comparison:

Nowadays, there is a gigantic assortment of charge cards accessible to Americans with great credit. Many deal liberal awards for regular buys. Today, they’ll take a gander at two more current Mastercards that you might not have known about, and analyze them. Continue to peruse for their Capital One Savor versus Uber Visa card comparison. These cards are presented by two separate banks yet in a lot of ways they are really comparative and both are among the best no yearly expense Mastercards accessible today.

Savor vs Uber Visa Similarities:

- Two of them have no annual fee

- Both cards are intended for those with good to excellent credit

- Two cards earn cashback rewards

- Cards have a tiered cashback earning structure

- Both cards offer no foreign transaction fees

- Although the similarities, there are also some main differences that are crucial to understanding if you’re trying to buy one of these cards.

Capital One Savor Review:

- Sign up bonus IS $150 after making a purchase of $500 in the first 3 months

- Issuing bank is Capital One

- No Annual fee

- Intro APR is 0% for first 9 months

- Other benefits: Auto rental impact harm waiver, maintenance agreement, 24hr travel help, travel mishap protection

- Cashback rates are 3% on dining, 2% on groceries, 1% on all other purchases.

- The advantages of the Savor are extraordinary for a no yearly expense card. Things like auto rental inclusion and travel mishap protection are generally just remembered for very good quality cards. This item is plainly showcased towards voyagers and foodies and it’s a strong choice for both.

Uber Visa Review:

- Sign up bonus is $100 after spending $500 in the first 3 months

- Issuing bank is Barclays

- No Annual fee

- There is no Intro APR

- Other advantages: $600 mobile phone insurance, $50 credit for subscriptions when you spend $5,000 in a year

- Cashback rates are 4% on dining and bars, 3% on select travel, 2% on online purchases, 1% on all other purchases

- Other than the perks, there’s no annual fee for the card and the $100 signup bonus is relatively good for a card with these perks.

Capital One Savor vs Uber Visa: Which one is Better?

- As far as continuous prizes rates, the Uber Visa is an unmistakable victor here. The 4/3/2/1% earning structure is exceptionally liberal. A huge load of costs fall under feasting/bars, travel and online buys, so with the Uber card a huge level of your costs will acquire 2% or more. The eminent special case here is food, where the Savor’s 2% cashback takes down the Uber Visa’s 1%.

- As far as information exchange reward and starting advantages, the Capital One Savor is an unmistakable victor. The Savor has a $150 information exchange reward in addition to 0% APR for a long time, while the Uber Visa information exchange reward is $100 with no promotion APR. The two cards have an exceptionally low least spending prerequisite of $500.

- As far as advantages, it’s somewhat of a shot in the dark. The Uber Visa might have the slight edge with the mobile protection and $50 articulation credit. Then again, the Savor offers liberal travel benefits like restricted auto rental impact inclusion. The winner relies upon your ways of managing money.

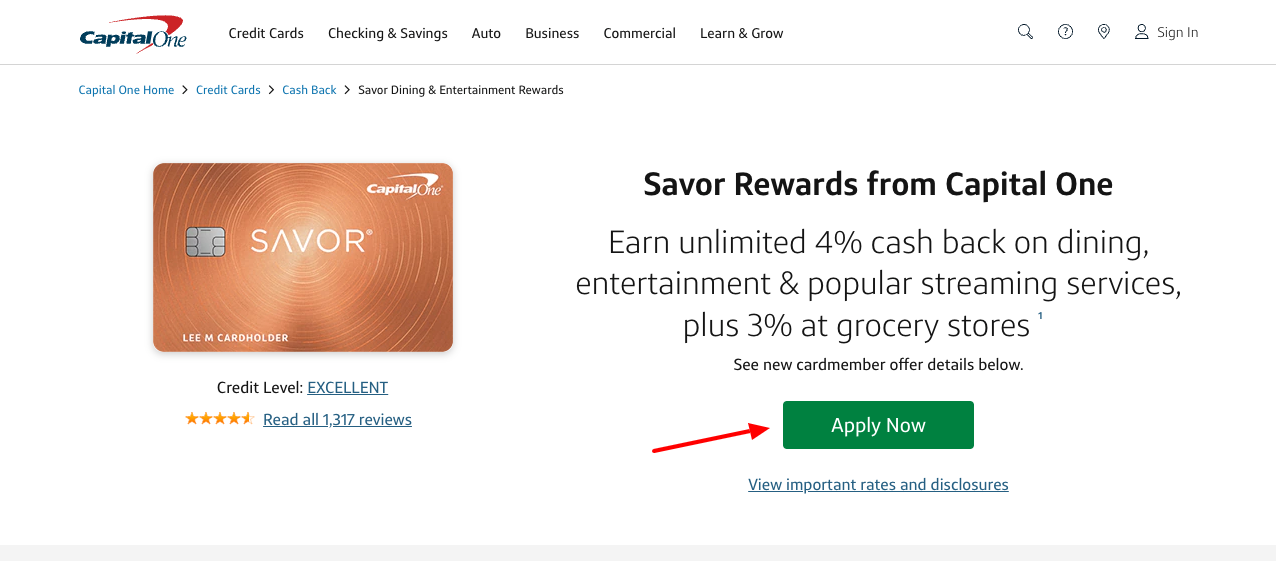

Apply for Capital One Savor:

- Capital One has several credit cards. Here let’s know about the Savor card.

- Copy and paste the URL www.capitalone.com/credit-cards/savor-dining-rewards in the address bar and hit enter.

- Find the Savor card you need and click on the ‘Apply now’ button.

- Provide your personal information, contact details, financial initials, extra information, read the terms click on the ‘Continue’ button.

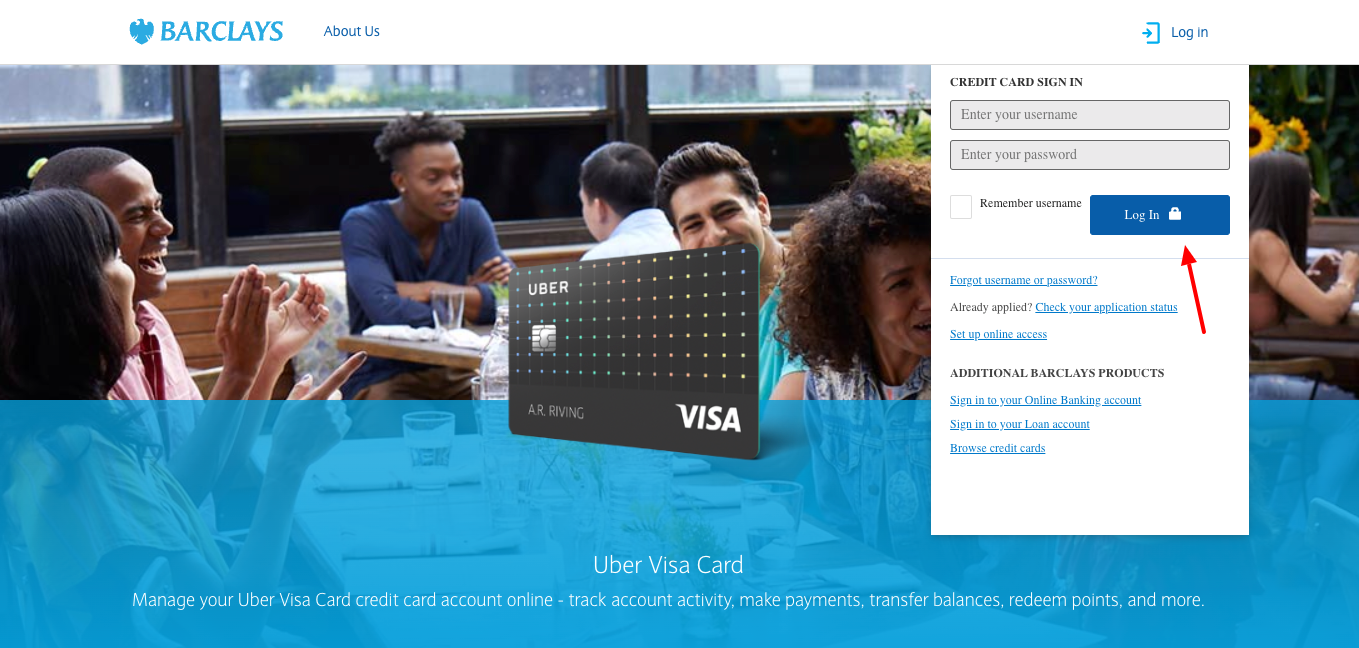

Apply for Uber Visa Credit Card:

- To apply for the card go to the website cards.barclaycardus.com/?p=uber

- You need to log in with the online account if you already have the card.

- If you do not then you must know that Barclays are not offering this card anymore. So you can check other card offers instead of this.

Frequently Asked Questions on Capital One Savor:

- Which is Better Capital One Quicksilver or Savor?

Capital One Savor is better for individuals who spend a great deal on eating and diversion. Capital One Quicksilver is better for individuals who need to acquire compensation at a level rate on all buys. Capital One Savor and Quicksilver share a ton practically speaking, including limitless money back remunerations and no unfamiliar exchange expenses.

- Which Is the Best Capital One Card?

The best Capital One MasterCard is the Capital One Venture Rewards Credit Card since it gives somewhere around 2 miles for every spend on all buys and has a prizes reward of 50,000 miles for new cardholders who spend,000 in the initial 3 months.

Also Read: How to Access American Express Serve Online Account

- Which Capital One Card Is The Best?

The best Capital One MasterCard is the Capital One Venture Rewards Credit Card since it gives somewhere around 2 miles for every spent on all buys and has a prizes reward of 50,000 miles for new cardholders who burn through,000 in the initial 3 months.

Capital One Credit Card Customer Information:

To get further assistance call on the toll-free number 1-800-655-2265.

Reference Link:

www.capitalone.com/credit-cards/savor-dining-rewards

www.capitalone.com/credit-cards