magine Gold Mastercard Review

Imagine Gold MasterCard Review and Guide:

The is the most popular for being one of the most outstanding subprime Visas available and a lifeline for many buyers. This card was one of the better notable unstable sub-prime cards before the monetary emergency in 2008. It is weighed down with high charges and low credit limits. On the off chance that you have awful credit and are searching for an unstable card, you ought to think about different contributions. You should be 18 years old or more seasoned and a lawful occupant of the United States to apply.

The Imagine Gold MasterCard is a sub-prime MasterCard offered at first by First Bank of Delaware and CompuCredit, which is like a considerable lot of different cards that are presented by these establishments. The possibility of essentially having a “Gold MasterCard” may appear to be a huge upside to awful credit customers, yet there are various genuine focuses about the Imagine Gold MasterCard that should be examined.

Imagine Gold MasterCard Rates:

- The annual Fee is $228

- The monthly Maintenance Fee is $4.95 to $6.50

- APR is P+11.90% which is a minimum of 19.90%

Imagine Gold MasterCard Review:

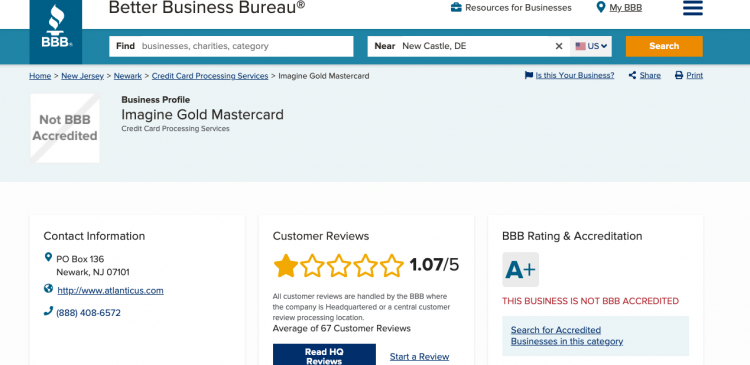

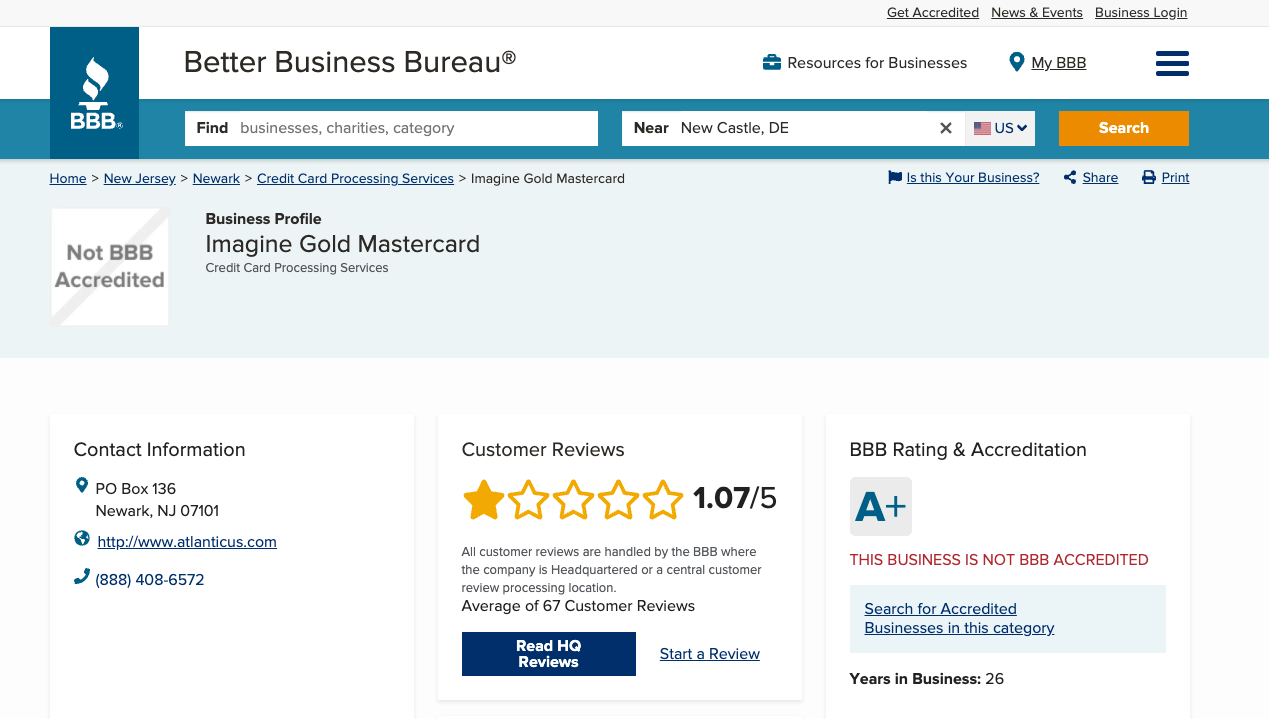

- Rates: To know more about this card you can visit the review webpage www.bbb.org/us/nj/newark/profile/credit-cards-and-plans/imagine-gold-mastercard-0221-7000097. Those Fees in staying aware of the other standard subprime cards, the Imagine Card additionally incorporates its higher than not unexpected expenses. The yearly expense for the Imagine Card is $150. Whenever you initiate your card, you will then, at that point, be charged a month-to-month upkeep expense of $6.50 which is another $78.00 per year however long you convey equilibrium. You will likewise have to pay a onetime arrangement charge of $4.95 whether you pick the EFT plan or the RCC plan.

- New cardholders get a credit breaking point of $300. In the wake of deducting the expenses, your underlying breaking point will be $150 and you will be qualified for a credit limit increment following a half year.

- Albeit the installment history is accounted for to every one of the three credit departments and could help layout or restore your record, one should genuinely think about whether a card with a $150 limit is truly worth having. This is without referencing that the yearly charge and month-to-month support expenses amount to $228 each year to have the card.

- APR: The APR is the prime rate in addition to 11.50%, with a base pace of 19.50%. The normal everyday balance strategy is utilized to compute the month-to-month balance. The beauty period allowed is 25 days.

- Peer Comparison: The Imagine Card is an unbelievably costly sub-prime card. While most subprime Visas have high charges, the envision MasterCard tips the upper finish of the expense scale. The yearly expense and complete month-to-month support charge amount to $228.00 per year!

- The Yearly Charges: During the primary year, the yearly charge is $75. From the second year onwards, the yearly expense is $45 yet a month-to-month handling charge absolutely $75 every year is charged. That implies that the continuous charge for this is $45 + $75 = $120 per year. While this is lower than Imagine, it is still high. The other card that is accessible today is the Credit One Visa. The yearly charge goes from $35 to $75, a substantially more sensible recommendation and they likewise report to each of the three credit agencies.

Also Read: Manage your American Express BCP Card Online

The Verdict:

The Imagine MasterCard all things being equal, the two primary guarantors are First Premier and Credit One Bank. Taking a gander at the charges and rates for these two cards, it is certain that they are a lot of lower than Imagine’s. In any case, in the days when Imagine card was still near, they would basically acknowledge anybody with genuinely awful credit. Nowadays, current sub-prime cards are somewhat more meticulous and the sort of cards you get endorsed for truly relies upon explicit conditions.

How to Apply for Imagine Gold MasterCard:

- This card is issued from the First Bank of Delaware. This bank has been taken over by Bryn Mawr Bank Corp.

- The website to the bank is bmt.com.

- However, you will not be able to apply for this card anymore as the offer has expired some time ago.

- If you have a good credit score you will want to stay away from the Imagine credit card and try something like the Chase Freedom card or the AMEX Gold Credit Cards, as those are two better cards.

Imagine Gold MasterCard Contact Details:

If you wish to know more about this card then call on 844.962.1972.

Reference Link:

www.bbb.org/us/nj/newark/profile/credit-cards-and-plans/imagine-gold-mastercard-0221-7000097