RISE is an internet based bank that spends significant time in working with customers with terrible credit. It offers credits from $500 to $5,000, which you can take care of north of four to 26 months-however advance sums and reimbursement terms accessible can differ from one state to another. The moneylender doesn’t charge application, beginning or prepayment expenses, yet its yearly rate rates are high contrasted and other portion credits.

This is what you really want to know before you apply. RISE individual advances have exceptionally high APRs, going from 36% to 299%, contingent upon your credit and where you live. So if you have fair credit or better, you might have the option to get considerably more reasonable financing somewhere else.

Rise Personal Loan Terms:

- APRs is 60% to 299%

- Loan Amount is $500 to $5,000

- Loan Terms is for 26 months

- Time to Receive Loan Money is for 1 to 2 business days

Eligibility for a Rise Personal Loan:

- RISE individual advances are by and large designated toward customers with unfortunate FICO ratings. The moneylender doesn’t list a base FICO rating, however that doesn’t mean you’re ensured to get endorsed. RISE will audit your financial record, pay and other data recorded on your application to settle on a choice.

- In the event that you’re uncertain about whether you’d qualify in light of your record as a consumer, you can get prequalified during the application cycle and view various offers in view of your reliability.

- RISE individual credits are not accessible to individuals from the tactical who are covered under the Military Lending Act.

- Likewise, the moneylender doesn’t permit cosigners, so on the off chance that you can’t get supported all alone, you’ll have to look somewhere else, regardless of whether you have somebody who will apply with you.

- Be somewhere around 18 years of age

- Live in one of the states where the moneylender works

- Have some work or other standard type of revenue

- Have a functioning and substantial financial records

- Have an email address where you can get account data.

Table of Contents

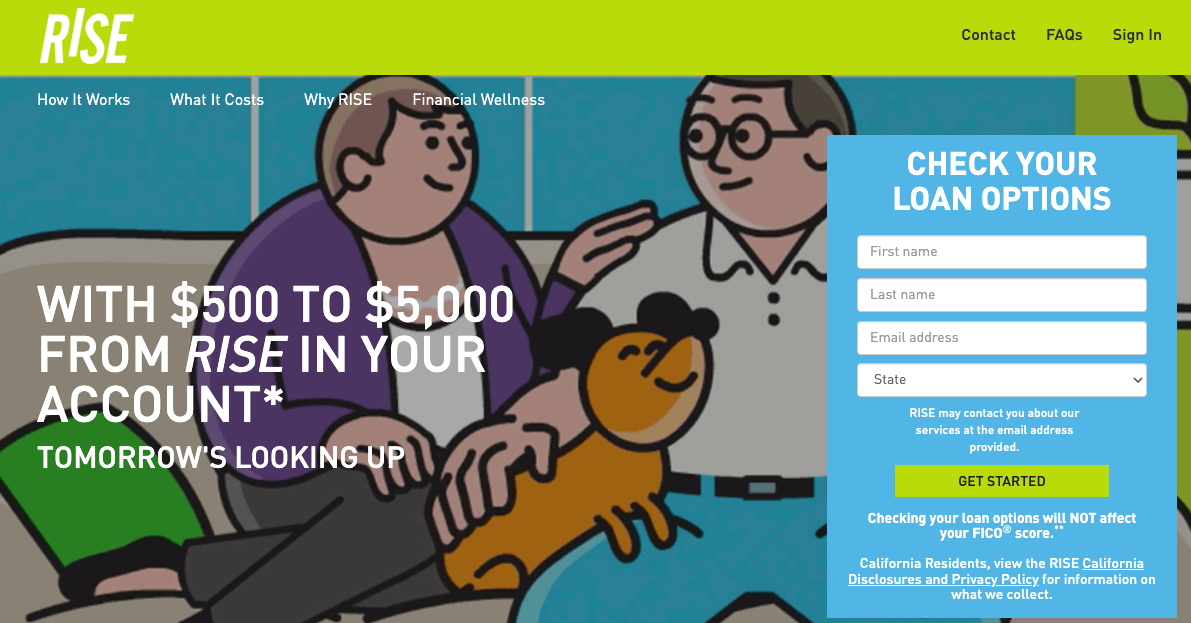

ToggleAccess Rise Credit Offer:

- Open a new tab in the browser and enter URL risecredit.com in the address bar

- Next at the center of the page you will get the loan options.

- Add the first name, last name, email address, state click on ‘Get started’ button.

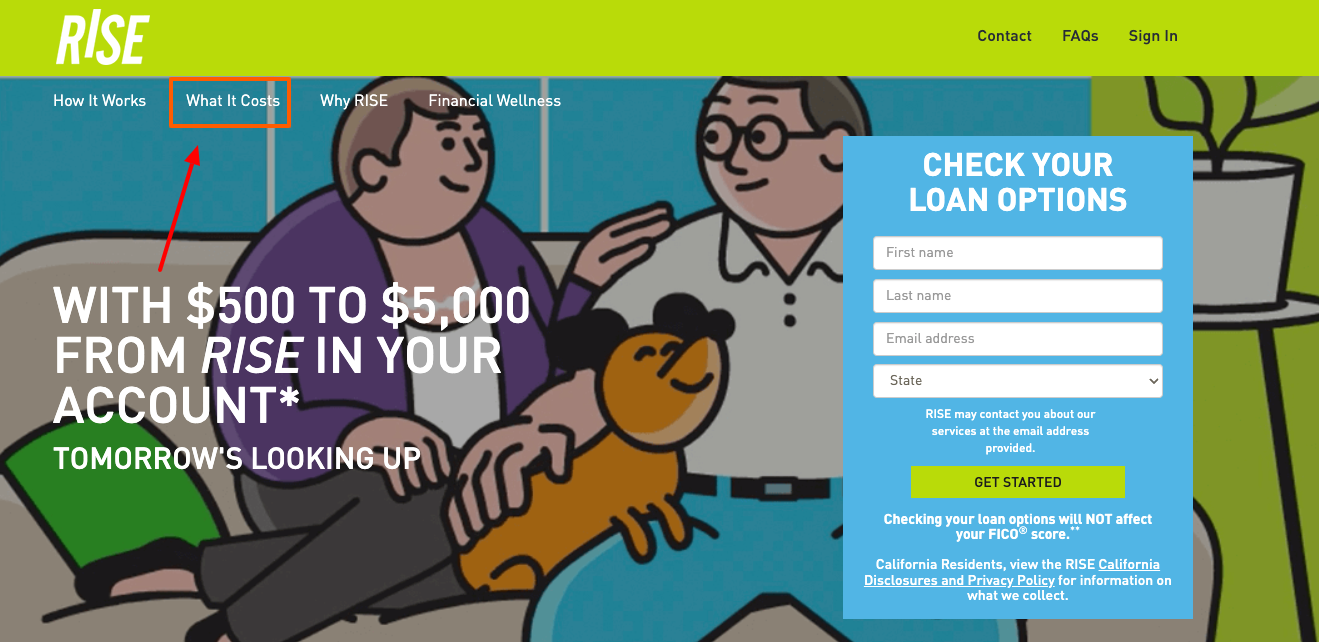

Apply for Rise Credit:

- Go to the web address risecredit.com

- At the upper left side of the page click on ‘What it costs’ tab.

- Next scroll down on the page click on ‘Apply now’ button.

- Choose your state and click on ‘Get started’ button.

- Provide your first name, last name, zip code, state, social security number, email, mobile phone, direct mail. Now click on ‘Continue’ button.

- Now follow the page instructions after this and complete the application.

How Rise Credit Works:

- Apply in Minutes: It’s simple. It’s protected. It’s everything dependent upon you. Apply now and you could be endorsed to get cash when tomorrow.*

- Pick Your Own Terms: With adaptable installment scheduling†, you can pick your own terms. What’s more, assuming that implies taking care of your credit early, feel free. In addition to the fact that there are no extra charges assuming you do, yet you could save money on the expense of your credit.

- Cash in Your Account: Funds can appear in your financial records when the following work day.

Also Read: Login to your SoFi Personal Loan Account

Rise Credit Bill Payments by Mail:

- You can send the payment through mail address.

- Send it to: Standard Payments: RISE Credit P.O. Box 679900 Dallas, TX 75267-9900

- Overnight Payments: RISE Credit Lockbox Number 679900 1200 E. Campbell Rd., Suite 108 Richardson, TX 75081.

Rise Credit Loan Notes:

- To get credit, you should apply on the web and have a legitimate financial records and email address

- Endorsement for credit and the sum for which you might be supported are dependent upon least pay necessities and differ by state

- Candidates living in Tennessee or Kansas are not permitted to get decreased rates.

Frequently Asked Questions on Rise Credit:

- Is Rise Credit A Payday Loan?

Rise Credit is an internet based portion advance for awful credit borrowers presented by Elevate, a Texas-based loaning organization. While its rates are lower than those of conventional payday banks, Rise credits are a costly method for getting cash in a crisis.

- What Credit Score Is Needed For A Rise Loan?

A “fair” FICO rating of around 600 may get you supported for considerably more reasonable items. Regardless of the expenses, RISE is straightforward with advance terms and loan costs. The advance terms accessible differ from one state to another. RISE offers portion advances in certain states and credit lines in others.

- Is Rise A Good Loan Company?

For buyers in critical circumstances who have awful credit, Rise might be a decent choice. Numerous clients believe Rise to be an extraordinary little advance moneylender because of the organization’s straightforwardness, credit announcing arrangements and prizes program that brings down the financing cost on future advances.

Rise Credit Contact Information:

For more information call on 1-866-580-1226. Fax: 1-866-580-1228. Or write to Customer Support PO Box 101808 Fort Worth, TX 76185.

Reference Link: