In this article you can find all information on the Get My Offer CapitalOne.com. We have provided a step by step detail on how you can respond to the Capital One Mail Offer. If you have received the mail offer then you will be able to accept it and get the credit card inside your wallet.

Capital One Bank offers pre-approved mail offer to those who are eligible to get the card. If you have received the mail offer then you can open your email inbox and follow the accept link. The user just needs to fill out a small form and they will get the card in the mail. Below we have explained the process in detail.

Table of Contents

ToggleAbout Capital One Pre Approved Offer

The pre-approved offer by Capital One Bank allows the users to get the credit card just by following a few simple steps. You do not have to go through the traditional process of applying for the credit card then waiting for the approval. The bank has sent eligible users a pre-approved credit card offer. In order to respond to the offer you need to accept it opening the email you received.

Capital One Bank has backed GetMyOffer.CapitalOne.com website. You can choose from a wide range of credit cards issued by the bank. Capital One is the issuer of credit cards that range from everyday credit cards to travel cards.

How to Accept Capital One Credit Card Mail Offer

- If you have just received the Capital One Credit Card Pre-Approved Offer then you must accept it.

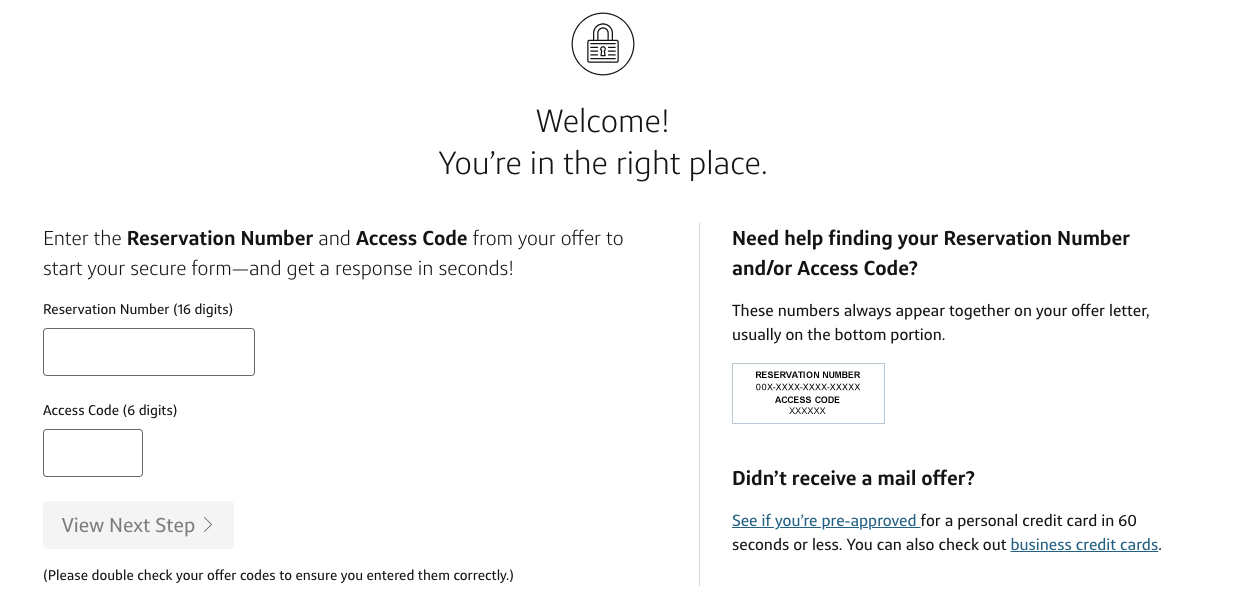

- To get started you need to visit to the Capital One website. getmyoffer.capitalone.com

- At the left there is a section to accept the pre-approved card offer.

- Once you have found it enter the following information:

- 16 digits reservation number

- 6 digits access code

- Click on the button below tagged ‘View Next Step’.

- Now you will find a new screen. Provide the required information and you can complete the process.

Capital One Credit Card Benefits

- The Capital One Platinum Credit Card is for those who want a great choice with average credit.

- You do not have to pay any annual fee for using the credit card.

- If you travel overseas then you can enjoy zero foreign transaction charges.

- The credit card approval process is fair as you can get approved with average credit.

Capital One Credit Card Rate and Fee

- APR rate for the Capital One Credit Card is 29.74% which is variable

- Annual fee is $0

- There is no introductory APR

- Credit score required is 630-689

- Capital One Platinum Credit Card cash advance fee is $3 or 3% whichever is greater

- Late payments can cost you$40

How to Apply for Capital One Platinum Credit Card

- To apply for the credit card you must open the application homepage. capitalone.com/credit-cards/platinum

- Look at the right of the screen then click on ‘Apply Now’ button.

- Click on it and a credit card application screen opens.

- Provide the required personal information in the respective blank spaces.

- Next complete the contact information and financial information sections.

- Read the additional information part and check the boxes that apply to you.

- Scroll down through the additional disclosures and tap on the ‘Continue’ button below.

- Follow the prompts next and you can submit the application form.

Capital One Credit Card Check Application Status

If you have applied for the card then you can check your status by calling Capital One on 1-800-903-9177. Provide your basic information for verification and you can know your application status.

How to Activate Capital One Credit Card

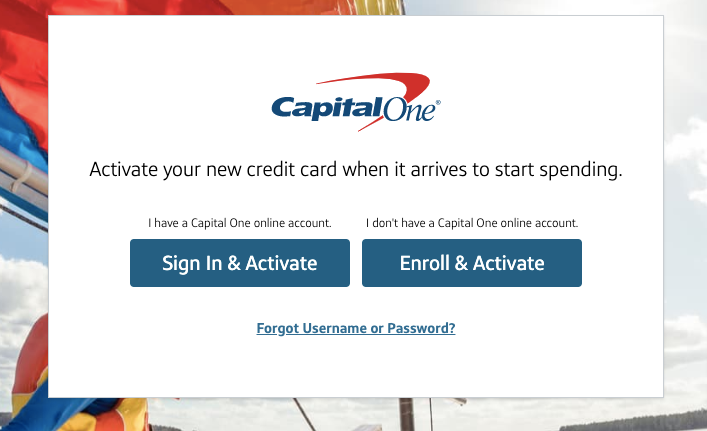

- To activate a newly received Capital One card open the activation homepage. verified.capitalone.com

- On the screen that opens you find two buttons namely ‘Sign in & activate’ and ‘Enroll & Activate’.

- If you are an existing account holder sign into your Capital One online account.

- Else register for an online banking account to activate your credit card.

How to Log into Capital One Credit Card

- For online account access open Capital One Credit Card Login page. capitalone.com

- Once the webpage opens there is a login section at the top.

- Provide username and password in the respective spaces.

- Click the ‘Sign In’ button and you will be logged in.

Forgot your Capital One Login Username or Password?

- For username and password recovery one must visit the Credit Card homepage. capitalone.com

- Now look below the space to enter the password.

- Click on the URL that reads ‘Forgot username or password?’

- A new screen opens that displays the username look up section.

- Provide the following details to get started:

- Last name

- Social security number

- Date of birth

- Tap on ‘Find Me’ button below.

- Once your account is found you can follow the prompts ahead to reset credentials.

Capital One Credit Card Frequently Asked Questions

Is Capital One a Good Credit Card?

Yes the Capital One Credit Card is a decent credit card with a fair amount of cash back and rewards for customers as well as small businesses. You can explore a wide range of credit cards at the website of Capital One.

What is the Capital One Credit Card Phone Number?

If you have issues with anything associated with the Capital One Credit Card then you can feel free to call on the Capital One Credit Card Customer Service number 1-877-383-4802.

How do I check my Capital One Credit Card Account Balance?

You can check your Capital One Credit Card account balance by logging into online banking. Once logged in you can check your balance under the accounts tab.

The user can also call on (877) 383-4802 and provide their account details to check balance.

Conclusion

Once you have accepted the Capital One Credit Card Pre Approved Offer you will receive the credit card within 7 to 10 days. Well, this was all we could provide on the Capital One Credit Card Get My Offer, Application and account login procedure.