Blue Cash Preferred® Card from American Express is a cash-back card tailor-made for our Covid-19-induced homebound behaviour. You can earn some of the highest rewards you’ll find on supermarket spending and select streaming services. You will get big rewards in multiple categories, the $0 introductory annual fee for the first year, then $95.-annual-fee. This card provides you strong rewards at U.S. gas stations and a wide variety of ways to get around like taxis, buses, trains and rideshares, making it a must-have in the wallet of anyone who cooks, streams content or gets around. You can get 6% back on select U.S. streaming services and while the list of eligible services is not too shabby, it’s unlikely to be a top-earning reward category—except, perhaps, for those media fiends with subscriptions to everything.

You just need to activate American Express Blue cash preferred credit card using the instructions above and enjoy exclusive perks, rewards, savings passes and much more.

Benefits and Rewards of American Express Blue cash preferred Credit Card:

With this credit card you can get tiered reward rates, so rewards are tied to your spending at the retailer.

- You will get 6% cash back at U.S. supermarkets on up to $6,000 per year in purchases (then 1%), 6% cash back on select U.S. streaming subscriptions, 3% cash back at U.S. gas stations and on transit (including taxis/rideshare, parking, tolls, trains, buses and more) and 1% cash back on other eligible purchases. Cash back is received in the form of Reward Dollars that can be redeemed as a statement credit.

- You can earn $0 introductory annual fee for the first year, then $95. annual fee.

- You will charge 0% introductory APR for 12 months on purchases from the date of account opening, then a variable rate of 14.24% to 24.24% applies.

- You can get a $300 statement credit after making $3,000 in purchases within the first 6 months.

- You can use your Blue Cash Preferred card to pay for Equinox+ at equinoxplus.com and receive $10 in monthly statement credits, in which enrolment required.

- When you will use this card to pay for the rental and the rental company’s insurance is declined then rental cars are covered with secondary coverage.

- This card will help coordinating and finding resources during a travel emergency.

- You will get return coverage up to $300 per item and $1,000 per year on eligible purchases made in the U.S.

- Get $0 cardholder liability for unauthorized transactions.

- You will get a payment plan option for purchases in categories under or over $100.

Table of Contents

ToggleAmerican Express Blue cash Preferred Credit Card Apply:

You can easily apply for the American Express Blue cash preferred Credit card either online or in-person at its store. If you want to apply for American Express Blue cash preferred credit card then follow these simple steps to apply online.

- First you have to visit the American Express Blue cash preferred credit card official website www.americanexpress.com/us/credit-cards/card/blue-cash-preferred

- Then type your last name and personal id code in the given space.

- Then click on Apply now button.

- Then you will be redirected to a new website where you have to fill up a form.

- Provide accurate informations about your employment and financial status.

- Finally, you have to review the fees associated with the credit card of your choice.

- Anyone can submit this application but the decision will depend on the applicant’s financial portfolio.

Eligibility for Applying American Express Blue cash preferred Credit card:

Applicants need to satisfy the following requirements by the bank to become a successful American Express Blue cash preferred Credit card holder.

- Applicants must have a American Express Blue cash preferred credit card’s online account.

- You must have a phone number.

- Applicants must be over 18 years of age to use the American Express Blue cash preferred credit card app.

- You must have a good credit score to get this credit Card.

- You must not been bankrupt or had an Individual Voluntary Arrangement or Debt Relief Order in the last six years.

- You must not have any outstanding County Court Judgement (CCJ’s) in the last six years.

- You must have proof of your current address.

- You need to have a good record of paying bills on time.

Fees and Charges:

- Annual Percentage Rate (APR) for Purchases: 0% introductory APR for the first 12 months from the date of account opening. After that, your APR will be 14.24% to 24.24%, based on your creditworthiness and other factors as determined at the time of account opening. This APR will vary with the market based on the Prime Rate.

- APR for Cash Advances: 25.49%. This APR will vary with the market based on the Prime Rate.

- Penalty APR: 29.99%. This APR will vary with the market based on the Prime Rate

- Paying interest: Your due date is at least 25 days after the close of each billing period.

- Plan fee: 0% introductory plan fee on each purchase moved into a plan during the first 12 months after account opening. After that, your plan fee will be up to 1.33% of each purchase moved into a plan based on the plan duration, the APR that would otherwise apply to the purchase and other factors.

- Annual membership fee: $0 for the first year, then $95

- Cash advance: Either $10 or 5% of the amount of each cash advance, whichever is greater.

- Foreign transaction: 2.7% of each transaction after conversion to US dollars.

- Late payment: Up to $40

- Returned payment: Up to $40

Needed credentials to activate American Express Blue cash preferred credit card:

You will need these below mentioned things to activate this credit card.

- First you will need a computer or mobile phone.

- Then a high-speed, stable Internet connection is required.

- You will need the details of American Express Blue cash preferred credit card.

- You will require the sign in details of this card.

American Express Blue cash preferred Credit Card Activation:

- Online method

You will need to have an online account first if you choose to activate your card online. But if you don’t have any online account then first sign up with details required i.e., bank account details, social security number and date of birth. Once you get online access, follow these steps to activate your card.

- First you have to switch on your computer or laptop.

- Then launch your browser.

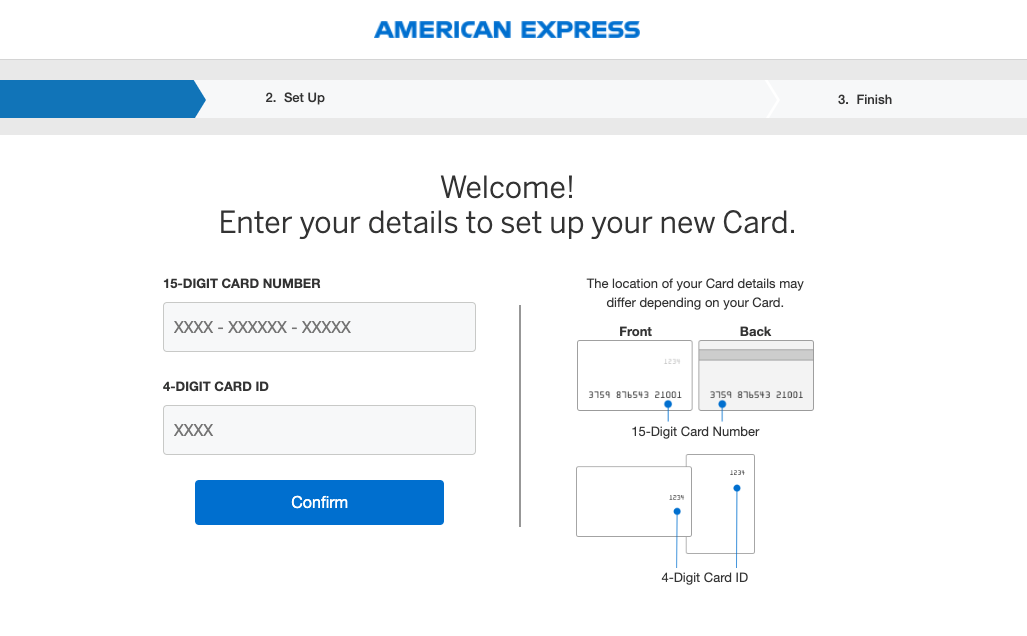

- Then you will need to type the activation link in the URL – www.americanexpress.com/activate

- You have to click on the “Activate my card now” option if you are a new card holder.

- Then another page will appear.

- There the system will verify your details to “ensure that you are the only person with access to the account”.

- There you have to provide the last 4 digits of your SSN, your birth details – MM/DD/YYYY and your “Account Number” in the given place.

- Then you have to enter the “Security code” provided on the back of the card.

- Then you will need to specify your “Occupation” from the drop-down menu (Engineer/Scientist, Doctor/ Dentist/ Pharmacist, Accountant, Education, Clergy/ Pastor, Cashier/ Clerk/ Server, etc.)

- After that you must clear on whether you are a US citizen.

- For that you have to Click “Yes” or “No” to the question “Are you a United States Citizen?”.

- Then press on the continue button.

- Finally, you have to Follow the onscreen guidelines to complete the card activation process.

Through phone call:

If you don’t have any Wi-Fi and still want to activate your card then you can follow these steps to activate your card.

- First you have to switch on your Phone.

- Then dial 1-800-419-2122.

- You have to Follow the instructions to easily activate your AMEX credit card.

- You can easily get the number from the “Contact Us” page if you have knowledge of internet.

- For that you just need to Visit the homepage of American Express Blue cash preferred credit card and select “Contact Us” option available there.

Also Read:

Login To Your American Express Document Center

How to Access Union Plus Credit Card Account

Manage your Zales Diamond Card Online

Benefits of Online Banking:

You can have some great advantages if you have an online account in American Express Blue cash preferred credit card. You must check out these features before creating an American Express Blue cash preferred credit card online account.

- With online banking you can check balances, transfer money and pay bills.

- You will be able to view and download statements.

- It will be easy to manage Direct Debits and standing orders.

- You can view your debit card PIN.

- You can easily report a lost or stolen card.

American Express Blue cash preferred Credit Card Log In:

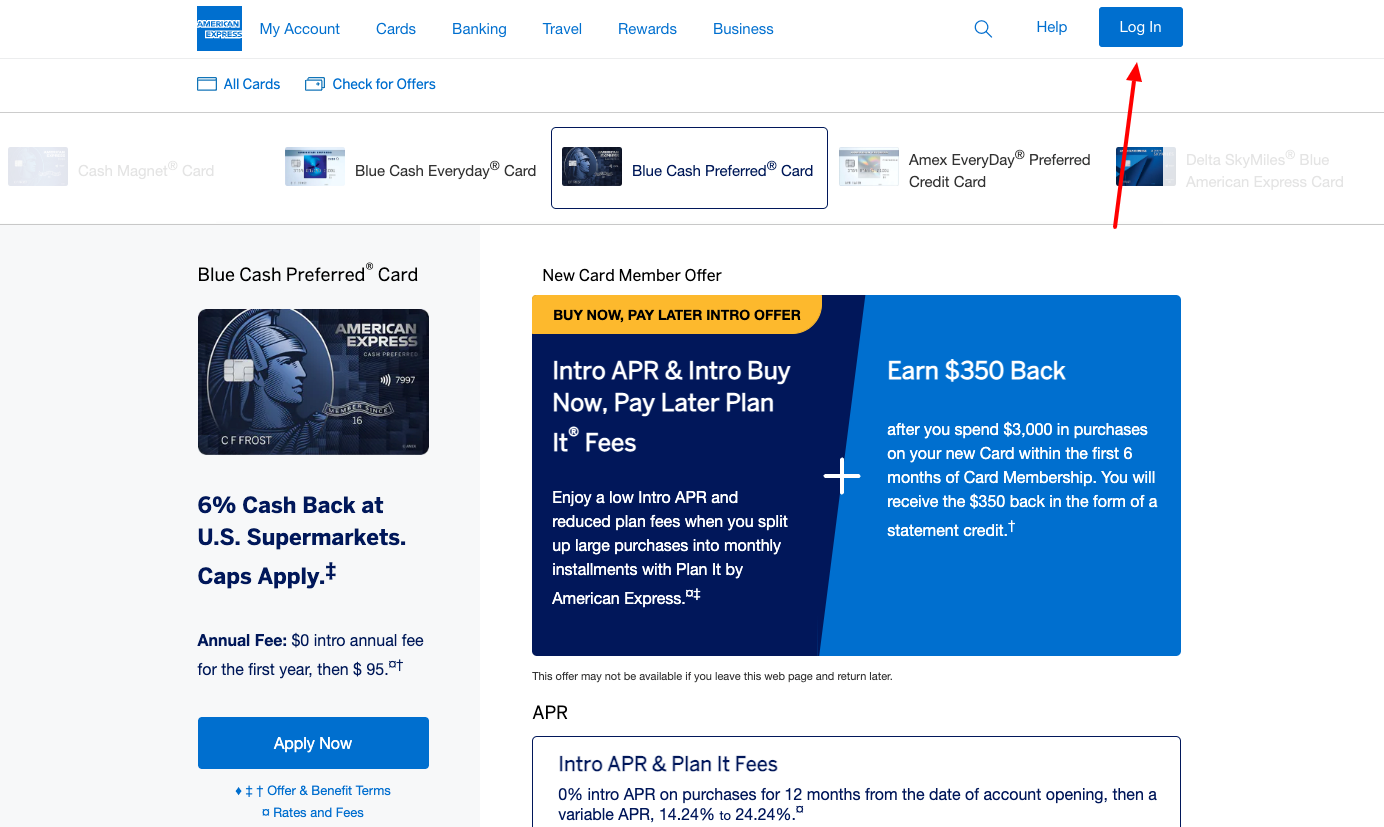

- First you have to Launch your web browser (Chrome or Safari) on the laptop or computer.

- Then you will need to navigate to www.americanexpress.com/us/credit-cards/card/blue-cash-preferred

- Then you have to tap on the login button.

- There you have to find for the option that says “Create new online account”.

- Provide your last name, and either your Online Banking membership number, your card number or your sort code and account number to the mandatory fields given.

- Click on ‘Next step’ option.

- Then press the ‘Log in with passcode’ option there.

- You have to create your user-name and password there.

- Then tap on the ‘Continue’ when you’re ready.

- Finally, tap on ‘Log in’ to continue.

- Provide your user-name and password to login to your account.

American Express Blue cash preferred Credit Card password recovery:

If you’ve forgotten any of your login details then don’t need to worry about. You need to follow these simple steps for resetting your user’s name or password.

- First you have to visit the American Express Blue cash preferred credit card login page www.americanexpress.com/us/credit-cards/card/blue-cash-preferred.

- You have to find for the “Forgot Username or Password?” link.

- You have to tap on it after finding the link.

- A new page will appear.

- Verify your account in that page.

- You have to provide the last 4 digits of your SSN, DOB in the DD/ MM/ YYY format, and Account Number there in the given place.

- Finally, you have to tap on the “Continue” button.

- You can retrieve your username or password easily.

American Express Blue cash preferred credit card bill payment:

You can use the American Express Blue cash preferred credit card website or mobile app for making an American Express Blue cash preferred credit card payment online. You can also pay by phone, through the American Express Blue cash preferred card mobile app, by mail or through online fund transfer. There you can also review your statements and account balance, can set up payment notifications and manage your card. There you can also choose how much to pay, when to pay it, and where the payment is coming from.

Online bill payment:

You’ll first need to set up online access and then log in through the site or app and set up a payment account like your savings or checking account.

- First you have to Log in to your American Express Blue cash preferred credit card account online.

- You can also launch the American Express Blue cash preferred credit card App on your mobile device.

- There you will have to choose “Payments” from the main navigation menu.

- There you have to select “Make a Payment.” Option.

- Then you will need to link an eligible checking or savings account from which to make payments.

- You have to choose “Add a bank account” option there and provide your account details.

- Then select a payment amount from the available options there and pay the minimum amount due, the full statement balance, the current statement balance, or enter another amount of your choosing.

- You have to select a payment date, or simply select “pay now” to send your payment on the earliest date available.

- Then choose a payment account from your available bank accounts.

- After that tap on “Review and Verify” to confirm the details of your payment.

- Finally tap on the “Pay now” to make your payment.

- You can set a payment date, amount, and payment account to be used for each automatic payment through selecting a Repeat payment option.

Set Autopay:

- First you will need to sign in to your account online.

- Then you have to click on ‘Pay Bill’ in the top menu bar.

- After that tap on the ‘AutoPay’ option and then click on ‘Set Up’.

- You have to choose an account from the ‘Pay To’ selector if you have more than one account.

- Then choose your payment account from the ‘Pay From’ selector.

- After that you need to select whether you would like to pay your Minimum Payment or Last Statement Balance.

- Then click on the continue button.

- Finally, you need to verify the details you selected are correct and click ‘Confirm’ to finish setting up AutoPay.

- You will get a confirmation notice with the start date of your first automatic payment.

Payment through mail:

If you want to use a check or money order but not cash, you can mail your payment in to American Express Blue cash preferred credit card. You have to Put your card number on the memo or note field of your money order or check so the company applies it to the right account. You have to be sure to send it early enough that it will arrive by the due date. Mail it to

American Express

P.O. Box 650448

Dallas, TX 75265-0448

Bill payment (Overnight):

American Express

Attn: Express Mail Remittance Processing

20500 Belshaw Ave

Carson, CA 90746

- Call In payment:

You can make a American Express Blue cash preferred credit card payment by phone using a checking or savings account which requires calling 1-800-472-9297 to reach the cardholders’ services.

The system will prompt you to give the last four digits of the card you need to pay during call and will ask for the last four numbers of your Social Security number to check that you’re the right card member. Then you have to confirm the information, you’ll access a voice automated system that will tell you information about your account such as your payment due date and minimum payment.

Then tell the automated system you want to make a payment and follow the prompts to give a payment amount and date and provide the information for the account you want to use to make a payment. At the end of the call, you will get a payment confirmation number.

Getting Started with your American Express Blue cash preferred Credit Card:

For starting the use of your American Express Blue cash preferred credit card, you have to follow certain steps which are mentioned below. Check out these steps before activating your card.

- First you have to activate your American Express Blue cash preferred credit card.

- Then visit www.americanexpress.com/us/credit-cards/card/blue-cash-preferred for set up online access.

- You have to update any bill payment services for paying your credit card bill with your new account information.

- You have to set up automatic bill payments for your account. Update online merchant accounts for storing your credit Card informations for expedited check outs as well as any digital wallets.

- You have to manage your account online, set up repeat payments, enroll in paperless statements for viewing your cards feature and benefits.

Lock your American Express Blue cash preferred credit Card:

You can instantly lock and unlock your American Express Blue cash preferred credit Card if lost or misplaced to prevent it from being used for purchases from its online website. You will also be able to set transaction limits and even block certain purchases for yourself or authorized users with its Control your card feature. American Express Blue cash preferred credit card will send you notifications through which you can monitor spending and catching fraudulent purchases as soon as they happen. You just have to follow these few simple steps.

- Open your American Express Blue cash preferred card online website first.

- Log in with your credentials.

- You will need to tap on “Account Services” on the top rail.

- Then within section “Card Management,” click “Freeze Your Card” option.

- After that you will be redirected to a page explaining what happens when you freeze your card.

- There you need to finish the action by clicking the “Freeze Card” button.

- This will stop new purchases with the card, including cash advances.

- The card will be automatically unfrozen after seven days of freezing it.

- You will need to repeat steps 2-4 to unfrozen it sooner.

- There you will find that “Freeze Your Card” will now be titled “Unfreeze Your Card.”

- Then you have to follow the prompts on the page to undo the freeze.

- Freezing your card won’t affect all the cards associated with your account for authorized users.

Customer Support:

For general concerns, there is a customer support which will help you 24 hours a day, 7 days a week.

- First you have to open a browser of your choice.

- Then you have to visit American Express Business Gold home page at https://global.americanexpress.com/help?inav=footer_contact.

- You will need to scroll down to the bottom of the page.

- Then locate to select the Customer Service option.

- After locating the Customer Service option, you’re now required to tap on Contact Us.

- After visiting the next screen, a couple of different assistance options will be displayed on-screen to seek help for the particular query or concern you’re looking to solve.

- For any further assistance you have to click on the See All option under American Express Business Gold Credit Card.

- Finally, you can find assistance for your concerned query through the different support options available.

You can call customer service at 1-800-528-4800. They are available 24*7.

TTY/TDD, Hearing Impaired TTY Relay:

Dial 711 and 1-800-528-480 24/7

Make a Payment: 1-800-472-9297

Apply for a card: 1-888-297-1244, 6 AM – 2 AM ET, 7 DAYS

Check application status: 1-877-239-3491

Mon – Fri: 8 AM – 12 AM ET Sat: 10 AM – 6:30 PM ET

Mailing address:

General Enquiries:

American Express

P.O. Box 981535

El Paso, TX 79998-1535

Bill payment:

American Express

P.O. Box 650448

Dallas, TX 75265-0448

Bill payment (Overnight):

American Express

Attn: Express Mail Remittance Processing

20500 Belshaw Ave

Carson, CA 90746

Reference:

www.americanexpress.com/us/credit-cards/card/blue-cash-preferred

www.americanexpress.com/activate