Table of Contents

ToggleHow to Apply for Citi Custom Cash Card with Invitation Code:

The Citi Custom Cash Card is one of the best cash-back credit cards with a zero annual fee. It differentiates itself from the other cards by giving the unique ability to earn up to 5% back on your top spending categories. Whether you are new or want a card that maximizes your purchases, this card is a good pick for your wallet.

Benefits of Citi Custom Cash Card:

You will get several cashback offers on your Citi Custom Cash Card. Here are some of the benefits that you will receive with your Citi Custom Cash Card:

- You will receive 5% cash back on purchases on your highest eligible spend category for each billing cycle up to $500.

- On all your other purchases, you will get 1% unlimited cash back.

- After you spend a total of $750 on the purchase within the first 3 months of your account opening, you will get a $200 cashback.

- You will get 0% intro APR on balance transfers and purchases for the first 15 months.

Rates and Fees of Citi Custom Cash Card:

- APR for Purchase: For the first 15 months from the date of your account opening, your introductory APR will be 0%. After that, your APR will vary between 13.99% to 23.99%, based on your creditworthiness.

- APR for Balance Transfers: The balance transfer APR will be 0% for the first 15 months from the first transfer date when transfers are completed within 4 months from the date of account opening. After that, your APR will vary between 13.99% to 23.99%, based on your creditworthiness.

- APR for Cash Advances: Your cash advance APR will be 25.24%, which can vary with the market based on the Prime Rate.

- APR for Citi Flex Plan: 13.99% to 23.99, depending on your creditworthiness.

- Minimum Interest Charge: If you ever charge any interest, then it will be no less than 50 cents.

Fees:

- Annual Fee: Citi Custom Cash Card does not charge any annual fee.

- Balance Transfer Fee: For each balance transfer, you will be charged either $5 or a minimum of 5% of the amount, whichever is greater.

- Cash Advance Fee: For the cash advance, you have to pay either $10 or a minimum of 5% of the amount, whichever is greater.

- Foreign Purchase Transaction: You will be charged 3% of each purchase transaction in US dollars.

- Late Payment Fee: If you fail to pay your Citi Credit Card bill pay the due date, then you will be charged up to $40.

How to Apply for Citi Custom Cash Card with Invitation Code:

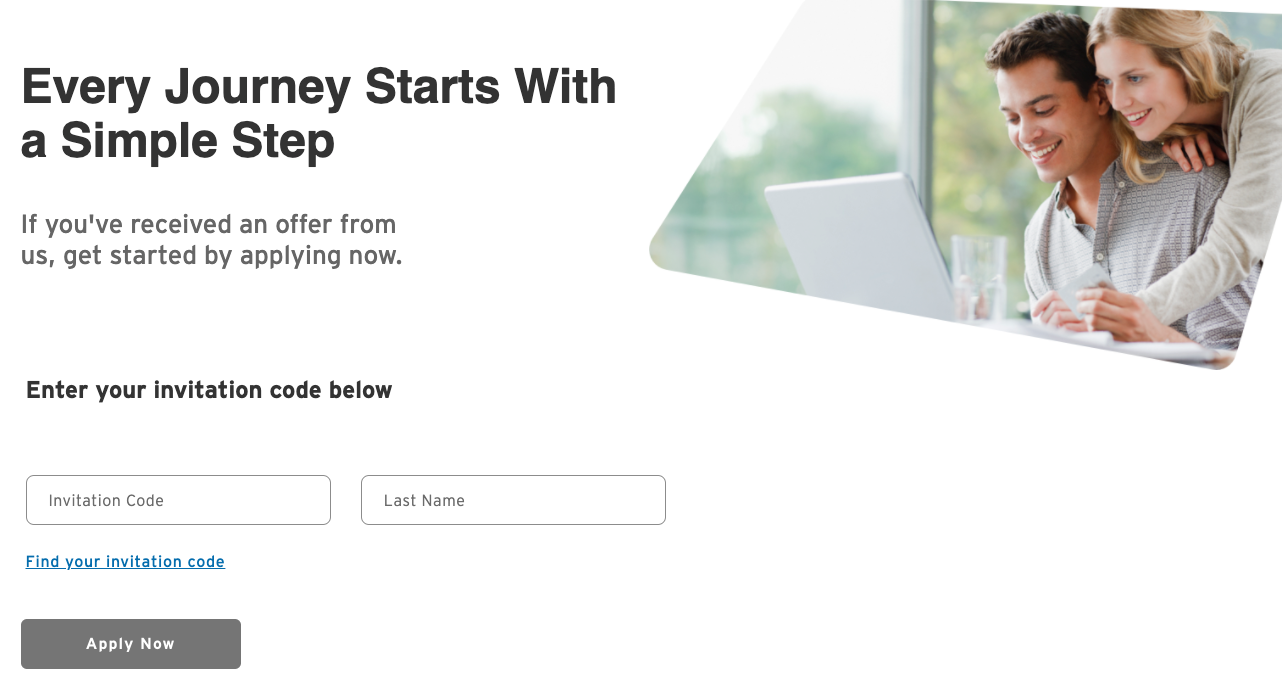

With the invitation code, you can easily apply for the Citi Custom Cash Card. If you have the invitation code with you, then follow these instructions below to activate your credit card:

- Firstly, you have to visit this link www.citi.com/lovecustomcash.

- By clicking on the above-mentioned link, you will be redirected to the application page.

- There, you have to provide your invitation code and last name on the given fields.

- After entering the required details, you have to select the Apply Now option.

- Then, you can simply follow the on-screen guideline to complete the application for Citi Custom Cash Card.

Also Read: How to Manage your Williams Sonoma Credit Card Online

How to Activate Citi Custom Cash Card:

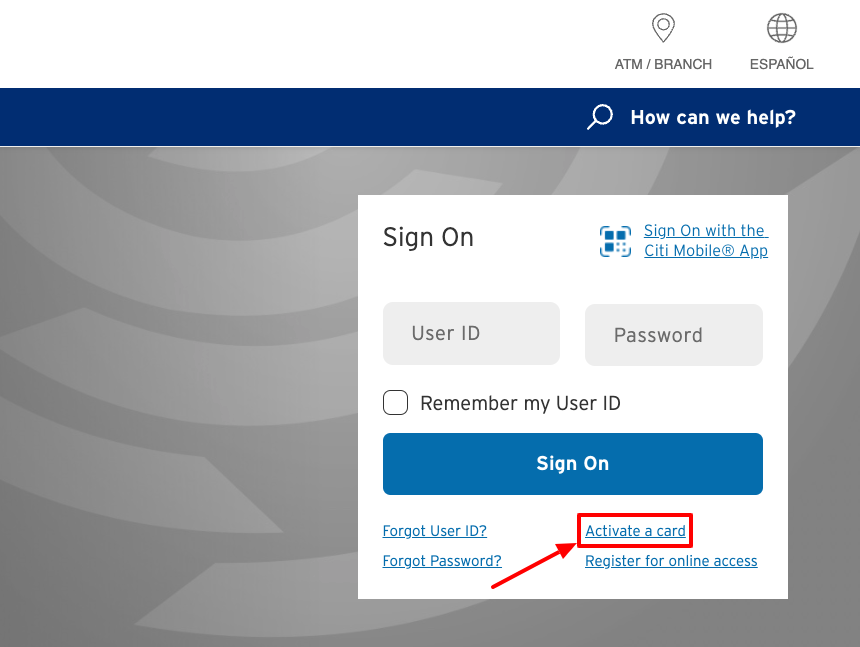

In order to use your Citi Custom Cash Card, you must have to activate your card. You can easily activate your credit card by following these easy steps below:

- Simply click on this link www.citi.com and it will take you to the Citi website.

- As you landed on the Citi Bank website homepage, you will get the login section.

- There, right under the Sign On section, click on the Activate a Card option.

- You have to enter your Citi credit card number and then click on the Continue button.

- After that, you just need to follow the steps further to successfully activate your Citi Custom Cash Card.

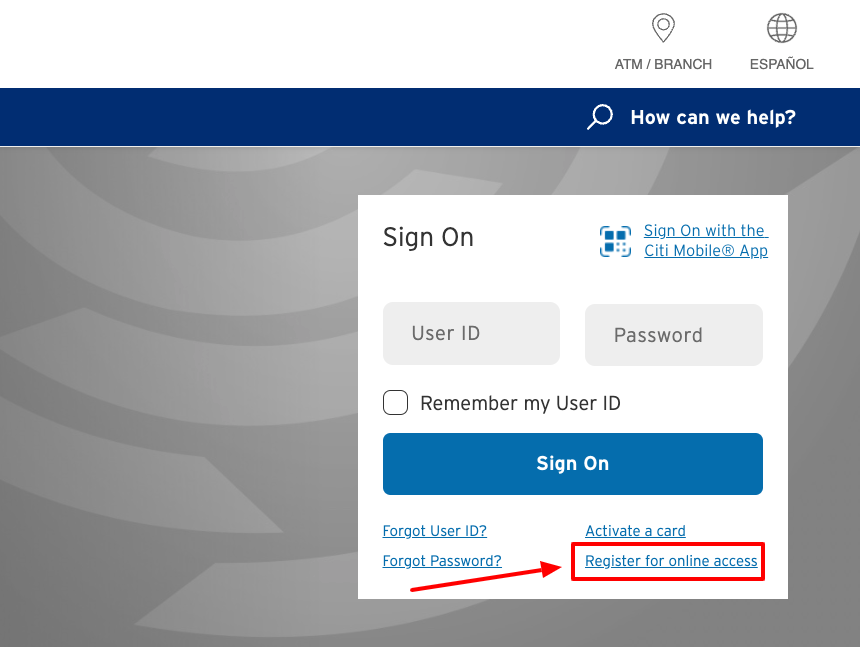

Register for Your Citi Credit Card Online Access:

To manage your Citi Bank credit card account, you must have to register for online account access. You can follow these instructions below to register for online access:

- Firstly, you need to click on this link www.citi.com.

- There, on the right side of the homepage, you will get the login section.

- You have to select the Register for Online Access option to proceed further.

- You can choose to register your account with a credit/debit card number or bank account or paycheck protection program loan account number.

- If you have to select the Credit/Debit Card, then provide the card details.

- After that, you just have to click on the Continue button for the steps further.

How to Make Payment for Citi Custom Cash Card Bill:

If you want to pay your Citi Custom Cash Card bill, then you can follow these simple instructions below:

Pay by Online Method:

It is the fastest and most convenient way to pay your Citi Custom Cash Card bill. If you have your registered login credentials with you, then you can simply follow these easy instructions below:

- Firstly, you need to visit this link www.citi.com for direct access to the Citi website.

- Then, on the login section, you have to input your registered username and password.

- Then, you can simply follow the Sign-On button to access the Citi online account.

- Once you logged in to your account, you have to look for the credit card payment option.

Pay by Mail:

You can also use the mail service to make the payment for the Citi Custom Cash Card bill. You can send them your payment in form of a money order or personal check. However, they don’t accept the payment in form of cash, so don’t send any cash payment. You just need to send your Citi Credit Card bill to this address below:

P.O. BOX 9001037

Louisville, KY 40290-1037

They also provide the option for overnight payment / express payment. If you like to use the overnight mail service, then you have to send your payment stub to this address below:

Citibank Express Payments

6716 Grade Lane

Building 9, Suite 910

Louisville, KY 40213

Citi Bank Contact Info:

Still, if you face any issues while applying for the Citi Custom Cash Card, then you can contact the customer service department.

General Correspondence:

Citibank Customer Service

P.O. Box 6500

Sioux Falls, SD 57117

Call At: 1-800-950-5114

TTY: 1-800-325-2865

Reference Link: