Association Privilege is a non-benefit arm of the AFL-CIO and gives buyer advantages to patrons through the Union Plus benefits program. The program additionally works together with Capital One, giving a few MasterCard, including the Union Plus Primary Access Card. The card is an unstable credit-building card intended to help a hailing FICO assessment with standard, on-time payments.

One of the most pleasant advantages of the Primary Access Card is that new cardholders might get an acknowledge limit overhaul in just five months from opening the record. Assuming that holders make their initial five installments on schedule, they’ll approach a higher credit line. Getting more accessible credit is an incredible method for helping your FICO assessment, as how much credit an individual can pull from impressively affects their general credit wellbeing and score.

Union Plus Card Benefits:

- Make 1.5% money back on all buys with no restriction to the sum you can acquire

- Get refunds and limits on AT&T, Teleflora, Union Plus Motor Club, and Car Rentals

- 0% APR for the initial a year

- Move Intro APR 0% for quite some time

- $ 0 yearly charge

- Accompanies shrewd chip innovation.

Union Plus Card Fees:

- Regular Purchase APR is 23.24% variable based on the Prime Rate

- Balance Transfer APR is 23.24% variable based on the Prime Rate

- Cash Advance APR is 23.99% variable based on the Prime Rate

- Cash Advance Transaction Fee is either $10 or 4% of the amount of each Cash Advance

- Late Payment Penalty Fee is up to $38.

Table of Contents

ToggleApply for Union Plus Card with the Invitation Code:

- To apply for the card with the invitation code use the link unionpluscard.com/applynow

- If the page is unresponsive you will be requested to Sign in with the online account.

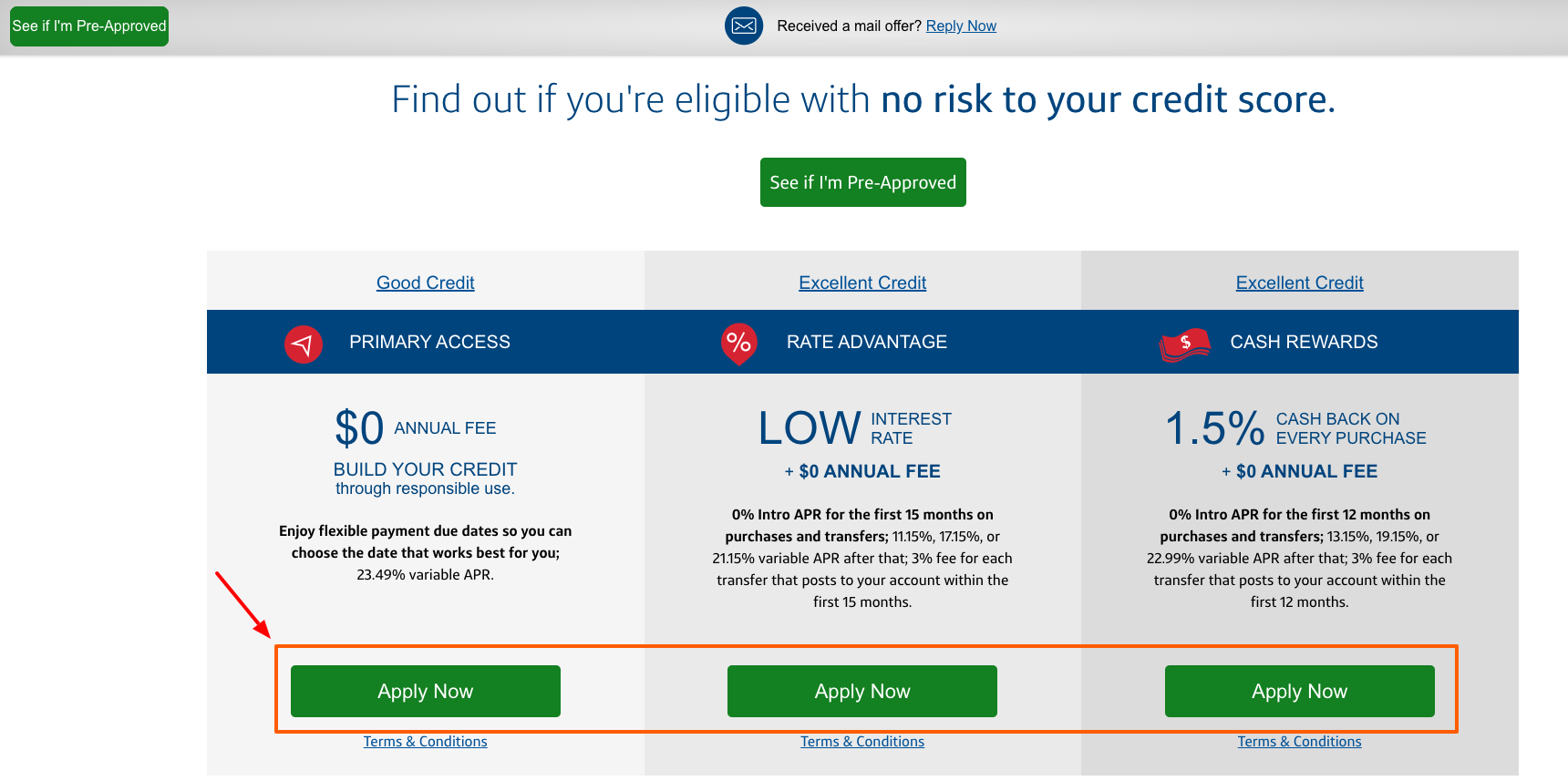

Apply for Union Plus Card:

- Visit the web address theunioncard.com

- Next scroll down on the page at the center choose the type of credit score you have and click on ‘Apply now’ button.

- Add your personal information, contact details, financial initials, add the user account. Click on ‘Continue’ button.

- Now follow the page instructions to complete the application.

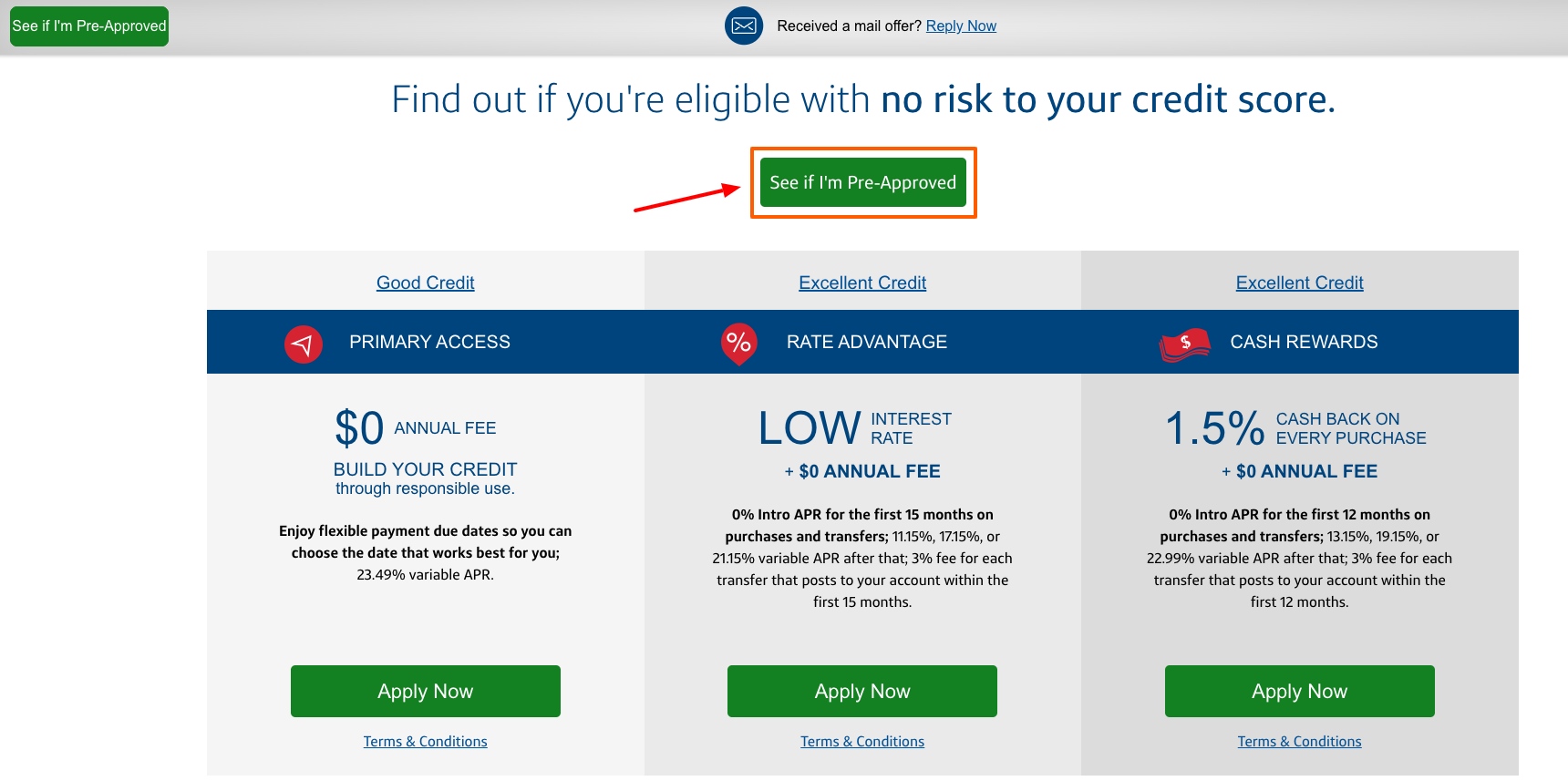

Get Pre-Qualified with Union Plus Card:

- To see if you are pre-approved visit the webpage theunioncard.com

- Secondly at the center of the page click on ‘See if I’m Pre-approved’ tab.

- Enter the required details and follow the page instructions.

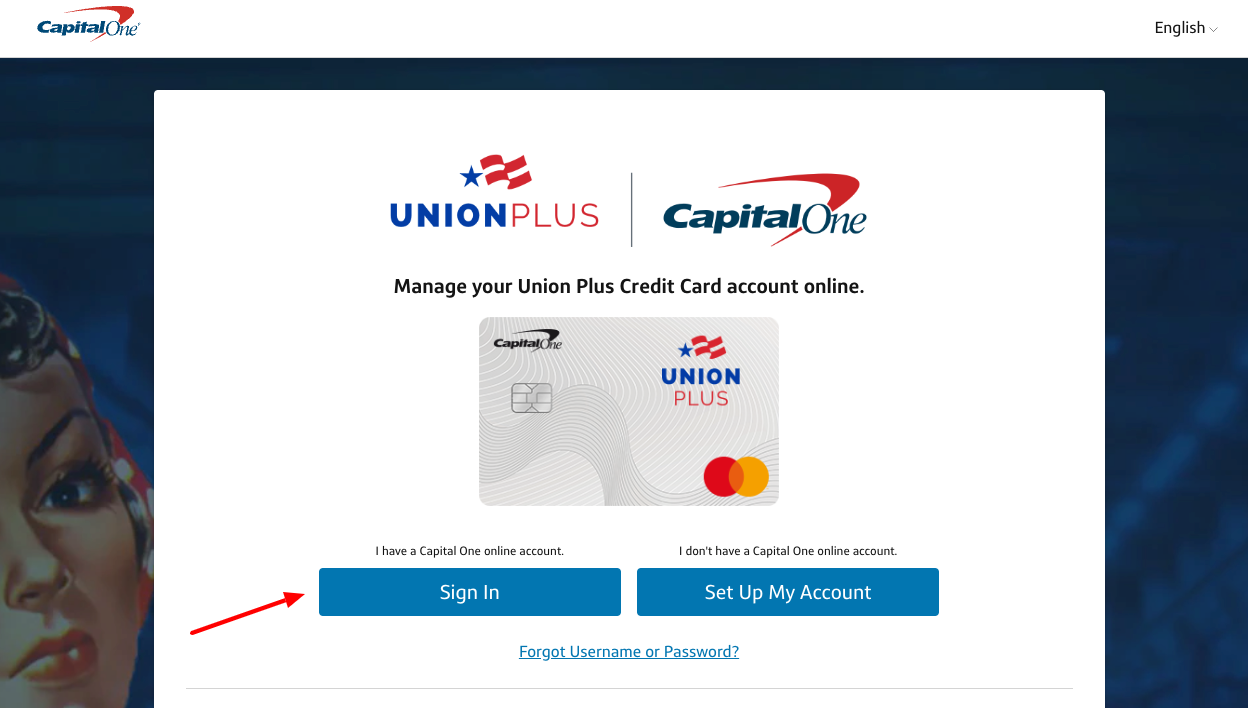

Login to your Union Plus Card Account:

- To login open card website unionpluscard.com/applynow

- Then click on Sign In button.

- At the top center side of the page provide username, password

- Now click on the ‘Sign in’ button.

Retrieve Union Plus Card Login Details:

- To retrieve the login information open the page capitalone.com

- Click on the ‘Forgot username or password?’ button.

- Add your name, SSN, date of birth complete the process by clicking on ‘Find me’ button.

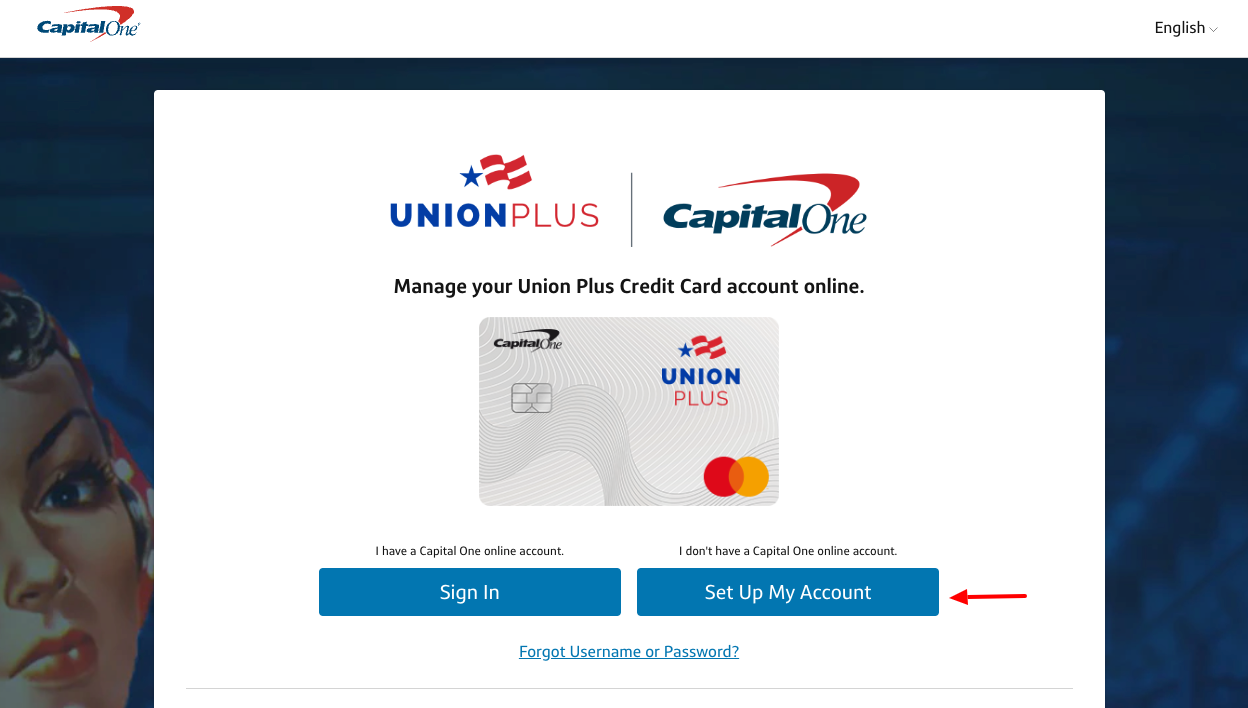

Sign Up for Union Plus Card Account:

- To sign up for the online account open the website unionpluscard.com/applynow

- Once the page appears you have to click on ‘Set up online access’ button.

- Add your name, SSN, date of birth and click on ‘Find me’ button.

Activate Union Plus Card:

- For the card activation use the link unionpluscard.com/applynow

- Login with the required information.

- After logging in you can utilize the credit card.

Also Read: How to Manage your PEX Visa Credit Card Account

Union Plus Card Bill Pay by Phone:

- Pay the credit card bill through toll-free phone number.

- Call on (800) 227-4825.

Union Plus Card Bill Pay by Mail:

- Pay the mail you can send the payment through money order or check

- Post the payment to, P.O. Box 60501, City of Industry, CA 91716-0501.

- The overnight address is Card Services Inc., ATTN: Exception Dept, 2012 Corporate Lane, Suite 108, Naperville, IL 60563.

Union Plus Card Bill Pay in Person:

- You can pay the bill in person at MoneyGram or Western Union places.

- Use your credit or debit card for bill payment.

Frequently Asked Questions on Union Plus Card:

- What is Capital One Union Plus?

The Capital One Union Plus Credit Card offers a serious 1.5% money back on all buys. That is in the vicinity of what the best money back MasterCard.

- What Is A Union Plus Card?

A credit association charge card is given by a credit association instead of a bank. Credit associations are not-for-profit associations that permit individuals to acquire from pooled stores at low financing costs. There is no government limit on the financing cost for bank advances.

- What Places Give Union Discounts?

Whether it’s night out or a pleasant family night out, appreciate scrumptious, association family limits at these cafés and some more

Union Plus Card Customer Help:

To get more support call on 1-800-867-0904.

Reference Link: