If you don’t want to go with a different issuer, then US Bank provides multiple credit cards. If a single platform looks more reliable to you, then you should consider usbank.com/myoffer. Currently, US Bank provides several credit cards for customers with good credit scores. Plus, it also has several other options if you want to improve your credit score over time. Most US Bank Credit Cards come with an affordable APR and a $0 annual fee.

If you have received a mail offer, then you should consider visiting usbank.com/myoffer to check out its term and become a cardholder right away with a simple application process.

Table of Contents

ToggleHow to Respond to US Bank Mail Offer

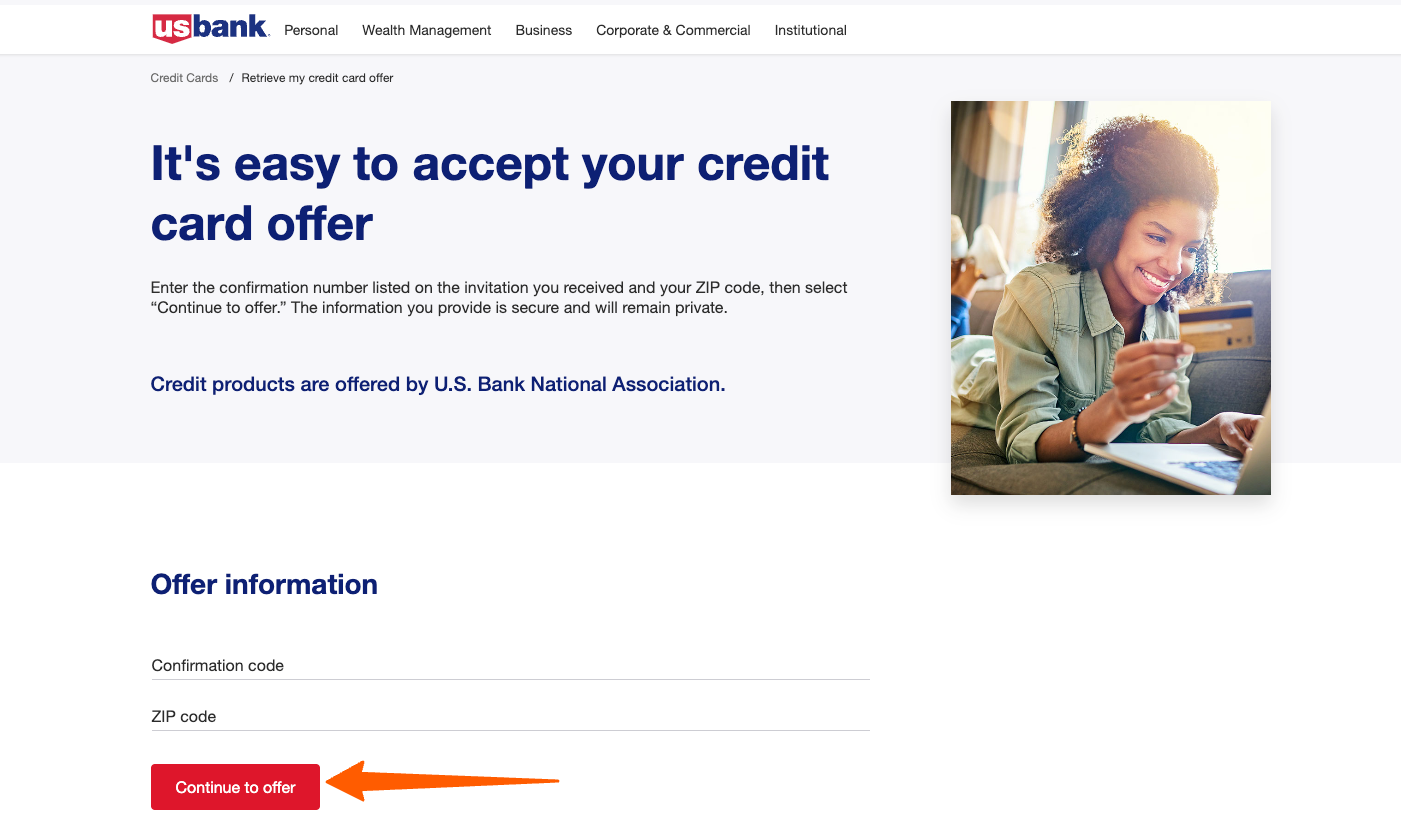

US Bank sends out credit card offers to consumers through the mail. This is reserved for consumers with good credit scores. You can easily access and proceed with your credit mail offer by visiting usbank.com/myoffer. Every applicant must have their confirmation code and zip code. If you have these things you can proceed with the simple instructions below:

- You have to visit this link usbank.com/myoffer.

- By clicking on the above-mentioned link, you will be redirected to the US Bank My Offer

- There, you have to enter your confirmation code and zip code on the given fields.

- After providing all the requested details on the given sections, you just need to select the “Continue to Offer” option.

- Then, simply follow the on-screen guideline to apply for the US Bank Credit Card.

Credit Cards Offered by US Bank

These are some of the best credit cards offered by the US Bank:

US Bank Cash++ Visa Signature Credit Card – Best for Cash Back Rewards

Visa Signature Credit Card provides a signup bonus of $200 when you spend $1000 within the first 90 days of getting the card. Plus, you will get 0% introductory APR on purchases and balance transfers for the first 12 months. After the introductory offer expires, your APR will vary between 13.99% to 23.99%.

The biggest advantage of getting this card is that it provides a 5% cash back when you spend $2000 on a combined eligible purchase.

US Bank Altitude Go Visa Signature Card – Best Card for Bonus Points

Many consumers are inclined towards applying for this credit card considering the amazing sign up bonus it provides along with the benefit of winning 4x points on food delivery, dine-in, and 2x points on grocery shopping, streaming services, and fuel points.

As a signup bonus, you will get 20,000 points by spending only $200 in the first 3 months of becoming a cardholder. Plus, you will get a $15 credit on the purchase of annual streaming services such as Netflix or Spotify.

The last benefit of choosing this card is that you don’t have to worry about interest charges for the first year. It has 0% introductory APR on purchases and balance transfers for the first 12 months.

US Bank Altitude Reserve Visa Infinite Card – Best Card for Travel Rewards

If you are looking for a travel rewards credit card, then US Bank Altitude Reserve Visa Infinite Card. Although the hefty annual fee is a huge drawback, this card does provide a number of other benefits as compensation.

One of the outstanding features of this card is that you can earn 50,000 bonus points that can be redeemed for $750 in travel redemptions. All you have to do in order to avail of this perk is spend $4,500 within the first 3 months of becoming a cardholder.

Cardholders can earn 5x points by booking a car or hotel through this credit card. They can also earn 3x points on purchases regarding travel, food delivery, food takeout, dining, etc.

US Bank Visa Platinum Card – No Annual Fee Credit Card

Like most of the other cards offered by the US Bank, this card also does not charge any annual fee. Plus, it has been approved as one of the best credit cards for the user’s convenience.

As compared to the other cards, US Bank Visa Platinum Card retains a 0% intro APR for the balance for the first 20 months. This means you have ample amount of time to pay off your debt without incurring interest charges.

Plus, this credit card comes with Cell Phone Protection. That means, your account is safe and private when you use it to pay your cellular bills every month.

US Bank Secured Visa Card – Best Choice to Rebuild Credit

Although this card does not come with any cash-back rewards or travel rewards points, it regularly reports to all three major credit bureaus which can help you to rebuild your credit score fast.

Since this card is a secured credit card, you can submit an initial security fee for easy credit card approval. This US Bank credit card does not charge any annual fee. If you simply maintain good spending habits with US Bank Secured Visa Card, you can check the substantial improvement in the look of your credit report.

How to Access the US Bank Credit Card Login

In order to manage your US Bank Credit Card or pay for your credit card bill, you must have to log in to your credit card account. You have to follow these simple instructions to access the US Bank Credit Card Login portal:

- You need to visit this link www.usbank.com.

- Then, from the top right-hand corner of the homepage, then select the “Log In” option for the next step.

- Make sure that Online Banking is selected, and provide your Username and Password.

- After providing your login credentials on the given section, you just need to select the “Log In” option.

US Bank Customer Service

If you have any queries regarding the US Bank Credit Card, then call the customer service department at tel :8008722657.

Also Read

Activate your Xfinity Mobile Phones Online

FAQs about US Bank Credit Card

Q: How to Activate my US Bank Credit Card?

A: If you are not logged into your US Bank account, then please refer to the number or website listed on the front of your credit card. If you are logged in to your account, then you have to follow these simple instructions below:

- Once you logged in to your account, select the My Account, then “Choose an account” to select your credit card.

- You have to choose the “Card Controls” option, then click on “Activate Card”.

- Then, enter your card information and follow the prompts to complete the activation.

Q: How to sign up for a paperless statement??

A: First, you have to log in to your US Bank Credit Card Login portal. You have to follow these simple instructions below to set up the paperless statement:

- You have to select the “My Accounts” option at the top of the page, select “My Documents”, then select “Paperless Preferences”.

- Mark the checkbox next to a specific account, or mark the check box to go paperless for all eligible accounts.

- You have to review the information and notification preferences, then click on the “Save” option.

Q: How do I report a US Bank Credit Card as lost or stolen?

A: If you don’t have your credit card, then you can close that card number or replace it with a new one. When they do that, they will send a replacement card to your address on file. If it needs to be delivered to a different address, you have to cardmember service at 800-285-8585*.

Conclusion

So, this is all for this article regarding the US Bank My Offer. Through this article, we have mentioned the step-by-step procedure to complete the US Bank Credit Card Application at USBank.com/myoffer. We hope, the above-mentioned details might be beneficial for you and it helped you a lot regarding your US Bank My Offer.