The Secretary of State oversees one of the biggest PC data sets in Illinois, monitoring around 8.7 million drivers; 11 million enlisted vehicles; 466,000 companies; 230,000 restricted obligation substances; 159,000 enrolled protections deals people; and 16,000 speculation counsel delegates. The workplace additionally is a significant asset for instructing residents about issues that influence their daily existences, including against intoxicated driving, traffic wellbeing, school transport security, protections extortion, education, and organ/tissue gift.

The Electronic Registration and Title (ERT) System permits you to finish and print an Application for Vehicle Transaction(s) (VSD 190) on the web. Then again, you might visit a Secretary of State office or contact their office at 800-252-8980 (complementary in Illinois) or 217-785-3000 (outside Illinois) to acquire a form.

Table of Contents

ToggleIllinois Vehicle Registration:

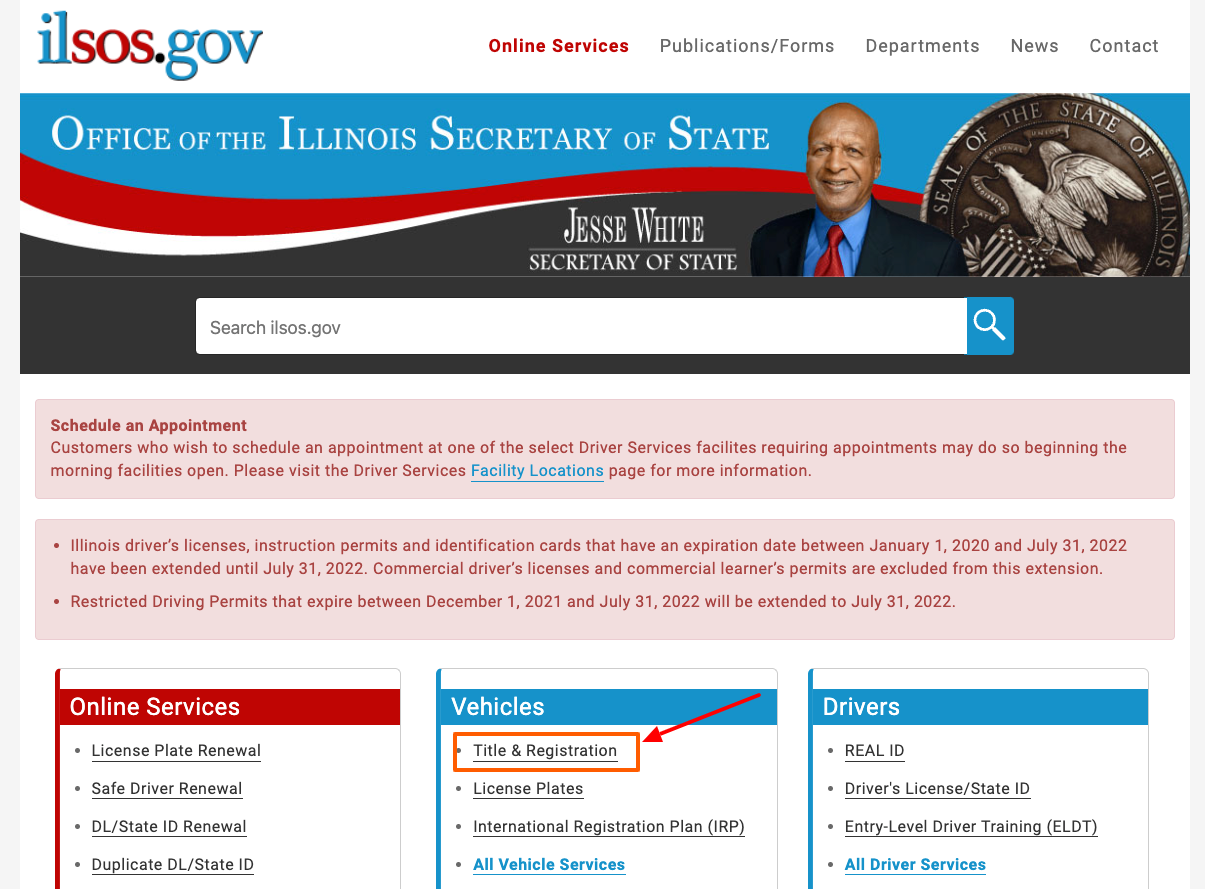

- Go to the Illinois vehicle registration website ilsos.gov

- Scroll down on the page and under the Vehicles section click on ‘Title and registration’ button.

- Click on ‘Apply for registration and title’ tab.

- Now click on ‘Electronic registration and title’ tab at the center left side of the page.

- The Electronic Registration and Title (ERT) System allows you to complete and print an Application for Vehicle Transaction(s) (VSD 190). In order to complete your transaction, you must take your completed application, required supporting documentation and payment to your local Secretary of State facility within seven days. You also may submit your paperwork and payment (check or money order only) by mail to the following address:

- Secretary of State. Vehicle Services Department: ERT Section, Rm. 424. If Expedited Title, Rm. 629. 501 S. Second St. Springfield, IL. 62756

- The ERT System may be used for the following transactions (mobile homes excluded):

- Title, Title and Transfer. Title and Registration, Corrected Title

- Any transaction involving the transfer of a motor vehicle from one person(s) to another must be accompanied by a completed Tax Form RUT-50 (Private Party Vehicle Tax Transaction). Individuals moving to Illinois who have purchased a vehicle from an out-of-state licensed dealer must submit a completed Tax Form RUT-25 (Vehicle Use Tax Transaction Return).Tax payments must be in the form of a separate check or money order payable to Illinois Department of Revenue.

- Now you can click on ‘Continue to application’ tab.

- Enter your last name, driver’s license, last four numbers of social security number and click on ‘Begin’ button.

Also Read:

How to Access N35 UKG Ultipro Employee Online Account

Login to your I campus Strayer Blackboard Account

MyBaylor EMR Employee Login Guide

The Process and Requirements of Illinois Vehicle Registration:

- Double-check Your Information: Ensure the vehicle data on the title is equivalent to on the application.

- Check that the title is appropriately doled out from the dealer to the purchaser and that the purchaser’s name in the task region is equivalent to on the application.

- Be certain that the odometer perusing is confirmed appropriately on the rear of the title and that the date of offer is demonstrated.

- Check the vehicle recognizable proof number on the title with the number on the scramble or entryway of the vehicle.

- Check in the event that vehicle use charge should be paid. Charge should be paid on all vehicle deals between people. How much assessment depends on the model year of the vehicle on the off chance that the selling cost is under $15,000 or on the selling cost assuming it is $15,000 or more.

- Show the quantity of the Temporary Registration Permit (TRP), whenever gave.

- Submit Application

- You should present your application, alongside an expense of $150 for the title and any relevant documentation, to the Secretary of State’s Office. Enrollment expenses are charged notwithstanding title expenses. Applications will be returned in the event that the data or expense is deficient to process.

- By mail: Secretary of State. Vehicle Services Department. 501 S. 2nd. St., Room 014. Springfield, IL 62756

- In-person: Find your nearest Secretary of State facility.

- Vehicles Purchased From an Illinois Dealer

- The dealer from whom you purchased your vehicle must submit the following items to the Secretary of State on your behalf:

- Sales Tax Transaction Return (form ST-556 Tax Form). Vehicles purchased from an Illinois dealer are subject to vehicle sales tax.

- Tax check made payable to Illinois Department of Revenue, Application for title and registration, the surrender document, Title and Registration fees.

Frequently Asked Questions on Illinois Vehicle Registration:

- More Info on Vehicle Services Illinois Secretary of State?

It provides Illinois vehicle owners with the most secure title document in the Electronic Registration and Title (ERT) for Service Providers

- Where will You Get the License Plate and Vehicle Registration Contact Form of ilsos.gov?

For more information about license plates and vehicle registration, please visit the Vehicle Services Department FAQ section.

- What about the License Plates Renewal?

Giving them the license plate number and address you used the last time you updated your vehicle’s address with the Illinois Secretary of State.

Illinois Vehicle Registration Contact Help:

For more help call on 800-252-8980 (toll free in Illinois). 217-785-3000 (outside Illinois). Or write to 213 State Capitol. Springfield, IL 62756.

Reference Link: