Chase credit cards are at the top of the pack and Chase has among the largest portfolios of credit cards in the market. Chase’s cards typically require good to excellent credit for approval. Their success depends on how faithfully they adhere to their core principles: delivering exceptional client service; acting with integrity and responsibility; and supporting the growth of their employees.

You just need to follow this article mentioned below to get a complete guide to Chase credit card.

Table of Contents

ToggleBenefits and rewards of Chase credit cards:

Chase freedom Unlimited card:

- This is a “set it and forget it” rewards card.

- You will earn 5% cash back on travel purchased through Chase Ultimate Rewards®, 3% cash back on eligible dining and drugstores and 1.5% on all other purchases.

- No annual fee.

- You will also earn 1.5% cash back bonus on everything bought in the first year as a cardholder on up to $20,000 in spending – that’s worth up to $300 cash back in the first year.

Chase Sapphire reserve card:

- You can earn 5 points per dollar on air travel and 10 points per dollar on hotels and car rentals when purchasing travel through Chase Ultimate Rewards® immediately after the first $300 is spent on travel purchases annually.

- Annual fee $550.

- You can also get 3 points per dollar on other travel and dining and 1 point per dollar spent on all other purchases.

- You can earn 50,000 bonus points after spending $4,000 on purchases in the first 3 months from account opening.

Chase Sapphire Preferred card:

- You can earn 5 points per dollar on travel purchased through Chase Ultimate Rewards®, 3 points per dollar on dining and 2 points per dollar on all other travel purchases and 1 point per dollar on all other purchases.

- Annual fee $95

- You can earn 60,000 bonus points after spending $4,000 on purchases in the first 3 months from account opening.

Chase freedom flex card:

- You can earn 5% cash back on up to $1,500 in categories that rotate quarterly (requires activation), 5% on travel purchased through Chase Ultimate Rewards®, 3% on dining and drugstores and 1% on all other purchases

- Annual fee none.

- You will get $200 bonus after spending $500 on purchases in the first 3 months from account opening.

Chase Ink Business Preferred credit card:

- You will earn 3 points per dollar on the first $150,000 spent on travel and select business categories each account anniversary year and 1 point per dollar on all other purchases.

- Annual fee Zero.

- You will get 100,000 bonus points after you spend $15,000 on purchases in the first 3 months from account opening.

Chase Ink Business Cash Credit Card:

- You will earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year and 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year.

- Annual fee zero.

- You will get $750 bonus cash back after you spend $7,500 on purchases in the first 3 months from account opening.

Chase Ink business unlimited Credit Card:

- You will get 1.5% cash back rewards on every business purchase.

- Annual fee zero.

- You will earn $750 bonus cash back after spending $7,500 on purchases in the first 3 months from account opening.

Chase Credit Card Application guide:

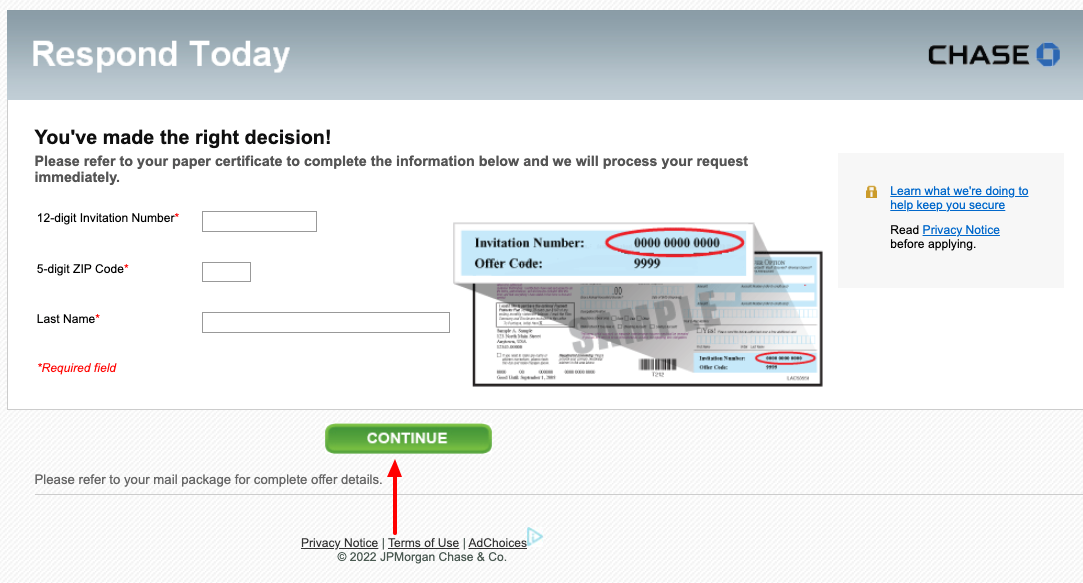

You can easily apply for the Chase credit card either online or in-person at its store. If you want to apply for Chase Credit Card then follow these simple steps to apply online.

- First you have to visit the Chase credit card official website sendmethecard.com.

- Then type your last name and personal id code in the given space.

- Then click on continue button.

- Then you will be redirected to a new website where you have to fill up a form.

- Provide accurate informations about your employment and financial status.

- Finally, you have to review the fees associated with the credit card of your choice.

- Anyone can submit this application but the decision will depend on the applicant’s financial portfolio.

Eligibility for Applying Chase Credit Card:

Applicants need to satisfy the following requirements by the bank to become a successful Chase Card holder.

- Applicants must have a Chase credit card’s online account.

- You must have a phone number.

- Applicants must be over 18 years of age to use the Chase credit card app.

- You must have a good credit score to get this credit Card.

- You must not been bankrupt or had an Individual Voluntary Arrangement or Debt Relief Order in the last six years.

- You must not have any outstanding County Court Judgement (CCJ’s) in the last six years.

- You must have proof of your current address.

- You must be a legal resident of the United States.

- You need to have a good record of paying bills on time.

Fees and Charges:

- Annual fee: Fees can range anywhere from $50 to over $500, with some lenders waiving the fee for the first year.

- Interest charges: You won’t be charged interest if you pay your entire balance each month by your due date. You could also get a card that offers a 0% intro APR. Note that this 0% rate is only temporary. The better 0% APR promotional rates usually last anywhere from 12 to 18 months. After that, the APR will return to its regular rate. Most credit cards have variable APRs, which means that the percentage fluctuates with the market. If you don’t pay your balance off by the time the promotional period ends, you’ll owe interest on the remaining balance.

- Late fee: If your payment is over 60 days late then you could be charged a penalty APR which will cause your interest rate to go higher than your regular APR. In addition, the longer your payment is overdue, the more damage your credit score may incur.

- Card replacement fees: Some credit card companies will charge you a fee if you lose your card and need a new one, though many will send you a new physical card for free. If there is a fee, it is typically between $5 and $15.

- Balance transfer fee: If you transfer an outstanding balance from one card to another, you’ll often be charged a balance transfer fee of 3% to 5% of your transferred balance.

- Foreign transaction fee: Some credit cards will charge you when you make a purchase in a foreign currency, either while traveling or shopping online. Foreign transaction fees are usually anywhere from 1% to 3%.

- Cash advance fee: A cash advance fee refers to using your credit card to take out cash. Credit cards typically charge 3% to 5% for each cash advance. In addition, you’ll also be charged interest on the money you take out which will accrue immediately.

Needed credentials to activate Chase credit card:

You will need these below mentioned things to activate this credit card.

- First you will need a computer or mobile phone.

- Then a high-speed, stable Internet connection is required.

- You will need the details of Chase credit card.

- You will require the sign in details of this card

Chase Credit Card Activation:

Online method

You will need to have an online account first if you choose to activate your card online. But if you don’t have any online account then first sign up with details required i.e., bank account details, social security number and date of birth. Once you get online access, follow these steps to activate your card.

- First you have to switch on your computer or laptop.

- Then launch your browser.

- Then you have to login to your online account.

- You have to click on the “Activate my card now” option if you are a new card holder.

- Then another page will appear.

- There the system will verify your details to “ensure that you are the only person with access to the account”.

- There you have to provide the last 4 digits of your SSN, your birth details – MM/DD/YYYY and your “Account Number” in the given place.

- Then you have to enter the “Security code” provided on the back of the card.

- Then you will need to specify your “Occupation” from the drop-down menu (Engineer/Scientist, Doctor/ Dentist/ Pharmacist, Accountant, Education, Clergy/ Pastor, Cashier/ Clerk/ Server, etc.)

- After that you must clear on whether you are a US citizen.

- For that you have to Click “Yes” or “No” to the question “Are you a United States Citizen?”.

- Then press on the continue button.

- Finally, you have to Follow the onscreen guidelines to complete the card activation process.

Through phone call:

If you don’t have any Wi-Fi and still want to activate your credit card then you can follow these steps to activate your card.

- First you have to switch on your Phone.

- Then dial the number on the back of your card.

- You have to Follow the instructions to easily activate your Chase credit card.

- You can easily get the number from the “Contact Us” page if you have knowledge of internet.

- For that you just need to Visit the homepage of Chase credit card and select “Contact Us” option available there.

Benefits of Online Banking:

You can have some great advantages if you have an online account in Chase Credit Card. You must check out these features before creating a Chase credit card online account.

- With online banking you can check balances, transfer money and pay bills.

- You will be able to view and download statements.

- It will be easy to manage Direct Debits and standing orders.

- You can view your debit card PIN.

- You can easily report a lost or stolen card.

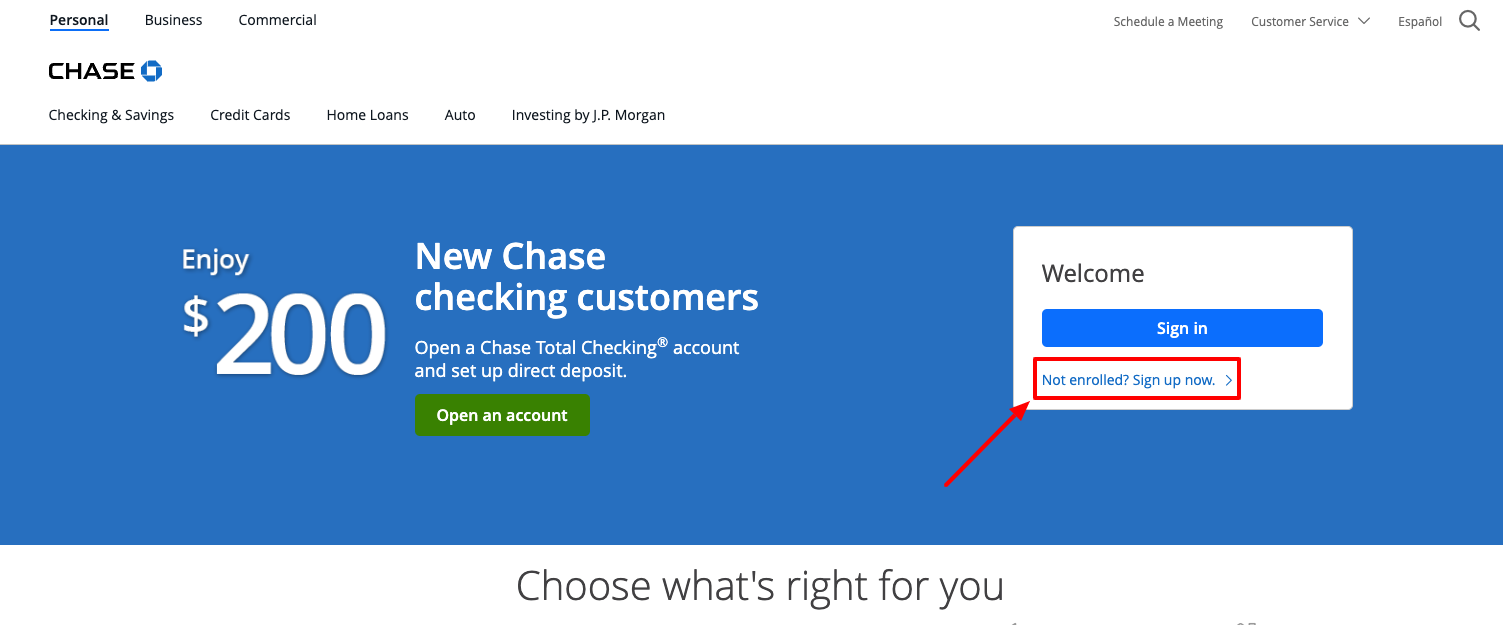

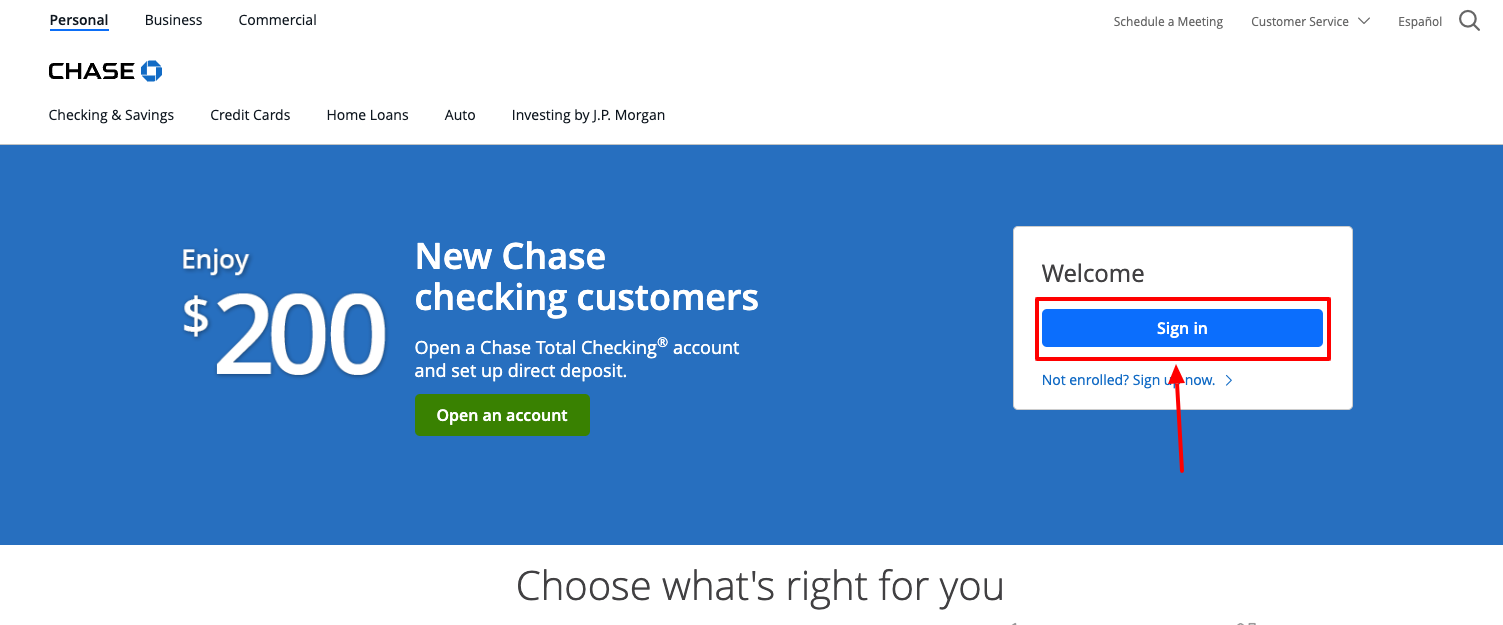

Chase Credit Card Log In and Sign up:

- First you have to Launch your web browser (Chrome or Safari) on the laptop or computer.

- Then you will need to navigate to www.chase.com

- There in case you are a new customer then, you have to find for the option that says “New enrolled? Sign up now”.

- Provide your credit card number, card security code, good through date, Social security number to the mandatory fields given.

- Click on ‘Next step’ option.

- Then create your user-name and password there.

- Then tap on the ‘Continue’ when you’re ready.

- For login again visit the login page.

- There you will be asked for your login details.

- You have to type the user-name and password in the given place.

- Finally, tap on ‘Log in’ to continue.

Chase Credit Card password recovery:

If you’ve forgotten any of your login details then don’t need to worry about. You need to follow these simple steps for resetting your user’s name or password.

- First you have to visit the Chase credit card login page www.chase.com

- You have to find for the “Forgot Username or Password?” link.

- You have to tap on it after finding the link.

- A new page will appear.

- Verify your account in that page.

- You have to provide the last 4 digits of your SSN, DOB in the DD/ MM/ YYY format, and Account Number there in the given place.

- Finally, you have to tap on the “Continue” button.

- You can retrieve your username or password easily.

Chase Credit Card bill payment:

You can use the Chase website or mobile app for making a Chase credit card payment online. You can also pay by phone, through the Chase mobile app, by mail or at a branch. There you can also review your statements and account balance, can set up payment notifications and manage your card. There you can also choose how much to pay, when to pay it, and where the payment is coming from.

Online bill payment:

You’ll first need to set up online access and then log in through the site or app and set up a payment account like your savings or checking account.

- First you have to Log in to your Chase credit Card account online.

- You can also launch the Chase credit card App on your mobile device.

- There you will have to choose “Payments” from the main navigation menu.

- There you have to select “Make a Payment.” Option.

- Then you will need to link an eligible checking or savings account from which to make payments.

- You have to choose “Add a bank account” option there and provide your account details.

- Then select a payment amount from the available options there and pay the minimum amount due, the full statement balance, the current statement balance, or enter another amount of your choosing.

- You have to select a payment date, or simply select “pay now” to send your payment on the earliest date available.

- Then choose a payment account from your available bank accounts.

- After that tap on “Review and Verify” to confirm the details of your payment.

- Finally tap on the “Pay now” to make your payment.

- You can set a payment date, amount, and payment account to be used for each automatic payment through selecting a Repeat payment option.

Also Read:

How to Manage your Amex Blue Cash Card Online

How to Manage your PEX Visa Credit Card Account

Application process for Citi Custom Cash Card Online

Set Autopay:

- First you will need to sign in to your account online.

- Then you have to click on ‘Pay Bill’ in the top menu bar.

- After that tap on the ‘AutoPay’ option and then click on ‘Set Up’.

- You have to choose an account from the ‘Pay To’ selector if you have more than one account.

- Then choose your payment account from the ‘Pay From’ selector.

- After that you need to select whether you would like to pay your Minimum Payment or Last Statement Balance.

- Then click on the continue button.

- Finally, you need to verify the details you selected are correct and click ‘Confirm’ to finish setting up AutoPay.

- You will get a confirmation notice with the start date of your first automatic payment.

- You have to pay at least your Minimum Payment for that month using a one-time payment to avoid a late fee if you set up AutoPay within 4 days of your Payment Due Date.

Payment through mail:

If you want to use a check or money order but not cash, you can mail your payment in to Chase credit card’s. You have to Put your card number on the memo or note field of your money order or check so the company applies it to the right account. You have to be sure to send it early enough that it will arrive by the due date. Mail it to

Cardmember Services

P.O. Box 6294

Carol Stream, IL 60197-6294

Call In payment:

You can make a Chase Credit Card payment by phone using a checking or savings account which requires calling 1-800-436-7958 to reach the cardholders’ services.

The system will prompt you to give the last four digits of the card you need to pay during call and will ask for the last four numbers of your Social Security number to check that you’re the right card member. Then you have to confirm the information, you’ll access a voice automated system that will tell you information about your account such as your payment due date and minimum payment.

Then tell the automated system you want to make a payment and follow the prompts to give a payment amount and date and provide the information for the account you want to use to make a payment. At the end of the call, you will get a payment confirmation number.

Getting Started with your Chase Credit Card:

For starting the use of your Chase Credit Card, you have to follow certain steps which are mentioned below. Check out these steps before activating your card.

- First you have to activate your Chase Credit Card.

- For this you have to set your online access.

- You have to update any bill payment services for paying your credit card bill with your new account information.

- You have to set up automatic bill payments for your account. Update online merchant accounts for storing your credit Card informations for expedited check outs as well as any digital wallets.

- You have to manage your account online, set up repeat payments, enroll in paperless statements for viewing your cards feature and benefits.

Lock your Chase Card:

You can instantly lock and unlock your Chase credit Card if lost or misplaced to prevent it from being used for purchases from its mobile app. You will also be able to set transaction limits and even block certain purchases for yourself or authorized users with its Control your card feature. Chase credit card app will send you notifications through which you can monitor spending and catching fraudulent purchases as soon as they happen. You just have to follow these few simple steps.

- Open your Chase credit card online website first.

- Log in with your credentials.

- You have to select the card you want to freeze.

- Then tap on the “Control Your Card” option.

- After that press the “Lock or Unlock this card” option there.

- You have to change the settings so that your card is in the locked position.

- This will stop new purchases with the card, including cash advances.

- But this will allow merchant-indicated recurring bill payments, returns, credits, dispute adjustments, payments, account fees, interest, and rewards redemptions.

You have to navigate back to the Secure hold page and unlock your card to use your card again.

Customer Support:

For general concerns, there is a customer support which will help you 24 hours a day, 7 days a week.

You can contact their customer service executives through these following details.

- First you have to open a browser of your choice.

- Then you have to visit Chase credit card home page at www.chase.com/digital/customer-service.

- After visiting the next screen, a couple of different assistance options will be displayed on-screen to seek help for the particular query or concern you’re looking to solve.

- For any further assistance you have to click on the See All option under Chase Credit Card.

- You will need to scroll down to the bottom of the page.

- Then locate to select the Contact us option.

Finally, you can find assistance for your concerned query through the different support options available.

Customer help and technical support:

Get online and mobile banking support, or help with your account.

Call Chase Customer Service: 1-800-935-9935

Get support from Chase Accessibility Services

Operator relay calls:

They accept operator relay calls. If you’re deaf, hearing impaired, or have a speech disability, call 711 for assistance.

Military personnel and veterans

Domestic Chase Military Services: 1-877-469-0110

Overseas: 1-318-340-3308

Operator relay calls:

They accept operator relay calls. If you’re deaf, hearing impaired, or have a speech disability, call 711 for assistance.

Reference: