How to Apply for the Citi Credit Cards

About Citi Bank

Citibank is the consumer division of Citigroup. Is was founded on June 16, 1812. The headquarter of Citi Bank is located in New York City, New York. It has over 2,500 branches in 19 countries. In the United States, it has 723 branches. Citi Bank offers Credit Cards, Personal Loans, Mortgages, Commercial Loans and Lines of Credit.

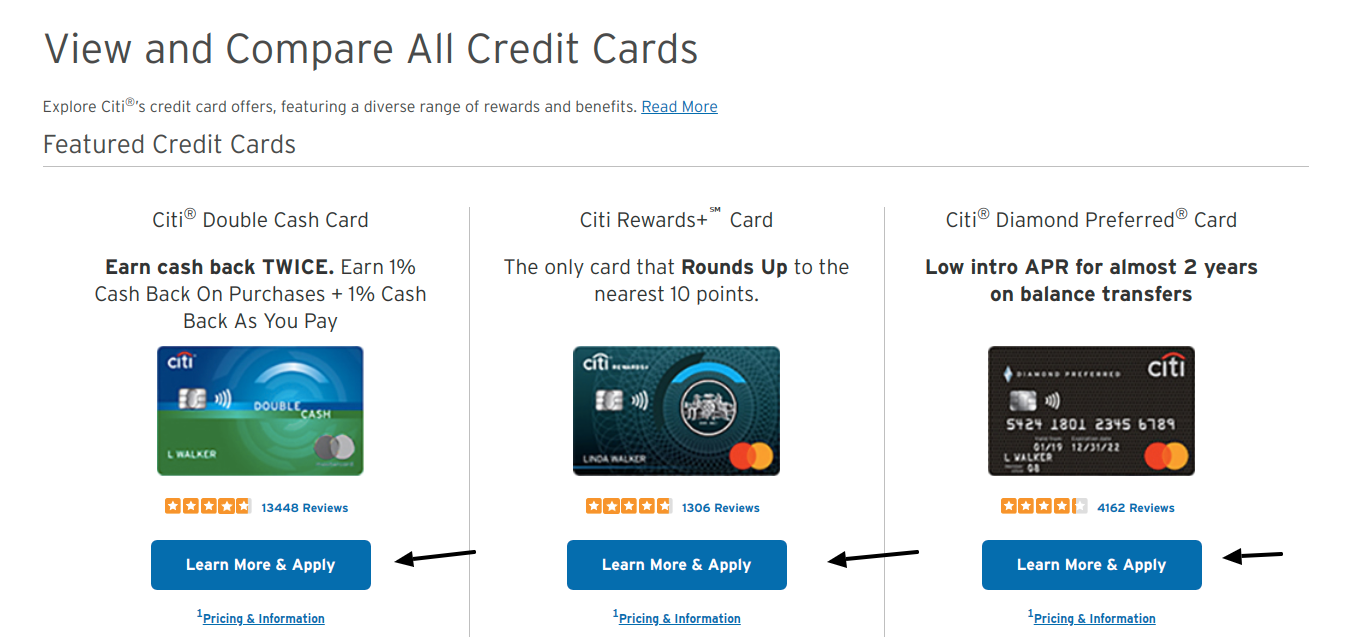

Some of the Best Credit Cards Offered by Citi Bank

If you are looking for the greater rewards, cashback or low interest then Citi Bank is the one for you. Citi bank offers several credit cards, features a diverse range of rewards and benefits. Here you will get every type of credit card, from travel cards to cashback and balance transfers to low introductory APR. Here are some of the best credit cards offered by the Citi Bank:

Citi Rewards+ Card:

Benefits:

In this card, you can earn 15,000 bonus points on your spend $1,000 in the purchase. But you have to purchase within the first 3 months.

Rates and Interest:

- There is no annual fee for this card.

- For the balance transfer, you have to pay $5 or 3% of the amount.

- For the first 15 months of balance transfers and purchases, introductory APR is 0%. After that, you have to pay 13.49% to 23.49%, based on your creditworthiness.

Citi Double Cash Card:

Benefits:

On your every purchase, you can earn 2% and 1% cashback. As you pay for those purchases, you will get the 1% cashback.

Rates and Interest:

- This card does not charge any annual fees.

- The annual percentage rate for this card is 13.99% to 23.99%. It can vary based on the market based prime rate.

- APR for the balance transfer for the first 18 months is 0% introductory. After that, it will be 13.99% to 23.99%. It can vary on the market based prime rate.

- APR for the cash advance, you have to pay the amount of 25.24%.

Citi Simplicity Card:

Benefits:

This is the only credit card, where “no” is a good thing. You do not have to pay any late fees, any penalty rate and annual fees.

Rates and Interest:

- There are no annual fees for the Citi Simplicity Card.

- For the first 12 months, the purchase APR is 0%. After that, you have to pay the amount of 14.74% to 24.74%, based on the creditworthiness.

- For the APR cash advance, you have to pay 25.24%.

Citi Premier Card:

Benefits:

After spending $4,000 within the first 3 months of account opening, you will earn 60,000 bonus points.

Rates and Interest:

- You have to pay the annual fees of $95.

- APR for the purchase is 15.99% to 23.99% based on creditworthiness.

- For the balance transfers, you have to pay the APR of 15.99% to 23.99% of the amount you transfer.

Citi Prestige Card:

Benefits:

After purchasing $4,000 in the first 3 months of account opening, you can earn 50,000 bonus points.

Rates and Interest:

- For the authorized users, the annual fee is $75 and the primary cardmember’s annual fee is $495.

- APR for purchase is 16.99% to 23.99%, based on your creditworthiness.

- APR for balance you have to pay 16.99% to 23.99%, based on your creditworthiness.

How to Apply for the Citi Credit Card

It is very easy to apply for the Citi Credit Card. You just have to follow some basic instructions to apply for the Citi Credit Cards. You may face a few problems for the first time. In that case, you can follow these instructions:

- First, you have to visit this link www.citi.com/rewardsdetails.

- Then, you have to click on the Credit Card and then select the View All the Credit Cards.

- There you will several credit cards. You can choose any credit card, which is most convenient for you want.

- You have to click on the Learn More & Apply option.

- Then, you have to click on the Apply Now option.

- Enter your first and last name.

- After that, you just have to enter the social security number.

- Then, enter your birth date.

- If you are a US citizen, then select Yes.

- Then, you have to enter your address and contact info.

- Enter your home address.

- Then, enter your zip code.

- Then, enter the city name.

- Then, select the state from the list.

- After that, you need to enter your mobile phone number.

- Then, enter your home phone number.

- Then, you just have to enter your email.

- Then, set a security word.

- Set the security answer for the questions.

- Then, you have to enter your financial information.

- Enter your total annual income.

- Then, enter your monthly mortgage/rent payment.

- Then, choose your type of account.

- Read the terms and conditions very carefully and click on the Agree & Submit button.

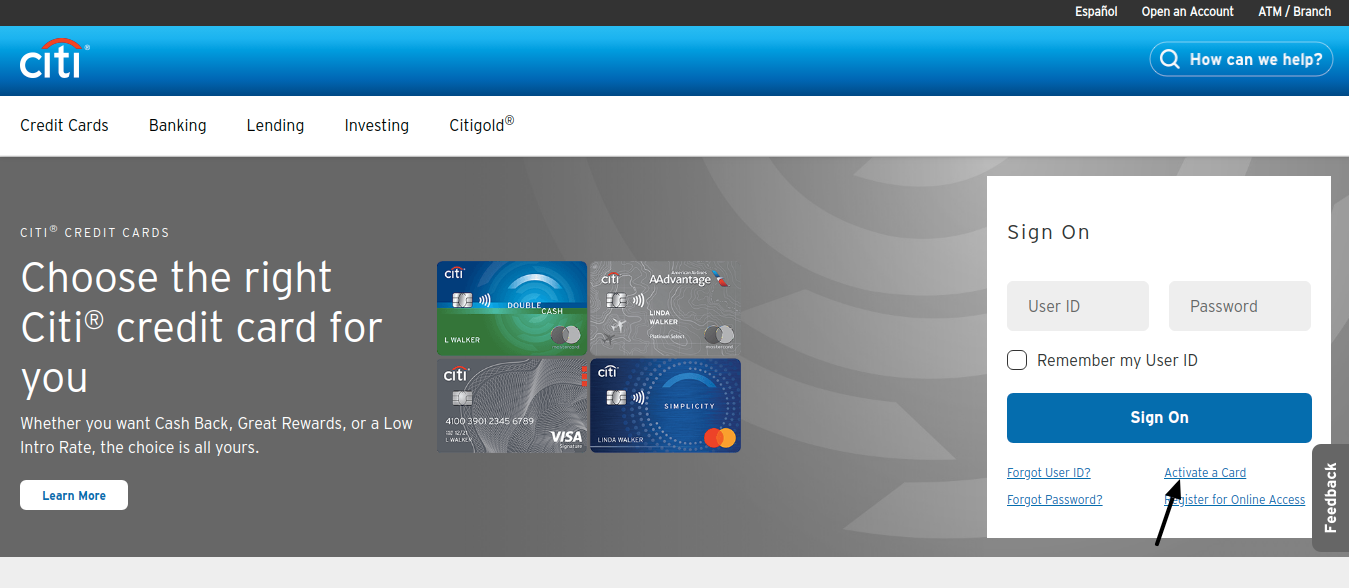

How to Activate Citi Credit Card

It is very easy to activate the Citi Credit Card. You just need to follow these instructions below to activate the Citi Credit Card:

- First, you have to visit this link www.citi.com/rewardsdetails

- On right side of the home page, you will see the login section.

- Then, you have to click on the Activate a Card option.

- Then, enter your card number on the given field.

- Then, you just have to click on the Continue button.

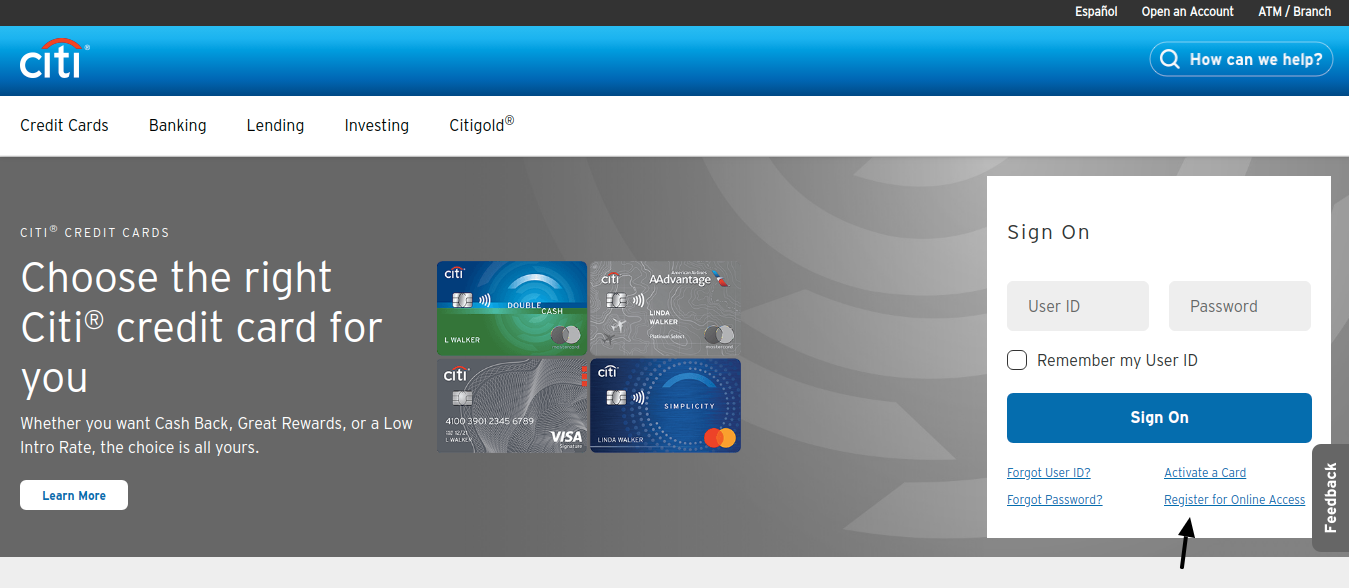

How to Register for the Citi Account

TO access your Citi Credit Card information and make the payment, you have to register for the Citi account. You have to follow these instructions to register:

- First, you have to visit this link www.citi.com/rewardsdetails

- You will see the login section, on the right side of the homepage.

- There, you have to click on the Register for Online Access.

- Then, you can register using your credit or debit card number or bank account number.

- If you select the credit/debit card number, then you enter your card number on the provided field.

- If you selected the Bank Account Number, then you have to enter your bank account number on the given field.

- Then, you have to click on the Continue Set-Up option.

- Then, follow further instructions to complete the process.

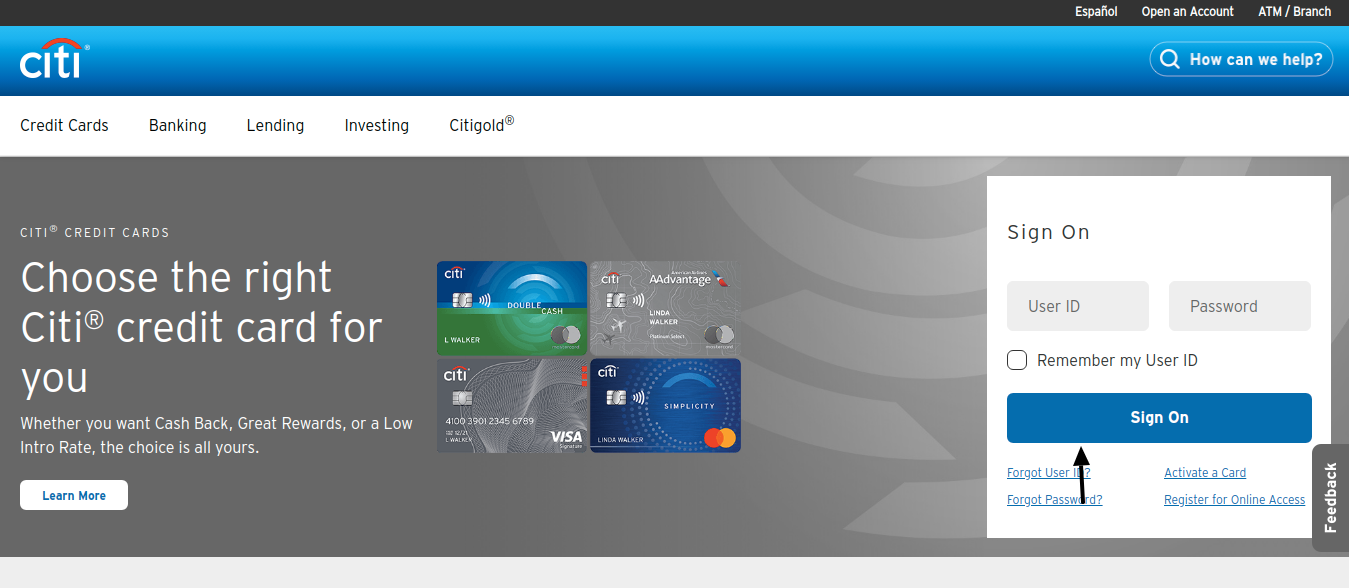

How to Sign In into Citi Account

If you already registered for the Citi account, then you should sign in to your Citi account. You can sign in into your account, by following these instructions:

- First, you have to visit this link www.citi.com/rewardsdetails

- You will see the login section on the right side of the page.

- There, you have to enter your user ID and password on the given fields.

- If you are using your personal device, check the Remember User ID box.

- After that, you just have to click on the Sign On button.

How to Reset Forgot User ID

In any case, you forgot your user ID, you have to reset the user ID by following these instructions below:

- First, you have to visit this link www.citi.com/rewardsdetails

- You will see the sign in the section on the right side of the page.

- There, you have to click on the Forgot User ID option.

- Then, you have selected Bank and/or Credit Card Customers.

- Enter your ATM/Debit or Credit Card number on the provided field.

- After that, you have to click on the Continue button.

How to Reset Forgot Password

The password is the important credentials to access your account. If you forgot your password, then follow these instructions below:

- First, you have to visit this link www.citi.com/rewardsdetails

- On the right side of the page, you will see the sign in section.

- There, you just have to click on the Forgot Password option.

- Then, you can choose Bank and/or Credit Card Customer, Mortgage Only Customer or Certificate of Deposit Only Customers.

- Then, select the Bank and/or Credit Card Customer and enter the details.

- After that, you have to click on the Continue button for further instructions.

How to Make the Payment

There are several ways to make a payment. You can follow these methods to make the payment:

Online Payment:

This is the best and easiest way to make the payment. To make the payment, you have to follow these instructions:

- First, you have to visit www.citi.com/rewardsdetails

- You will see the sign in the section on the right side of the page.

- There, you have to enter your user id and password on the provided field.

- After that, you have to click on the Sign On option.

- After entering the portal, you can make the payment very easily.

Pay by Mail:

You can also make the payment over your mail. You can send your payment with all the required details to these below:

P.O. BOX 9001037

Louisville KY, 40290-1037

Contact Info

General Correspondence:

Citibank Customer Service

P.O. Box 6500

Sioux Falls, SD 57117

Call at:

1-800-950-5114

Reference Link